Financial topics

-

Higgenbotham

- Posts: 8127

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

This is the ratio of high yield corporates to investment grade corporates. Black vertical line is the stock market peak (2014 is the peak at this time).

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

-

Higgenbotham

- Posts: 8127

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

Two years isn't a long time, but I noted it above also.There was also further evidence that risk aversion is becoming more acute throughout the corporate debt market. Spreads for riskier corporate bonds were said to move to the widest levels in two years.

http://www.safehaven.com/article/32786/transitions

http://www.zerohedge.com/news/2014-02-1 ... bbles-popsCredit growth in the years leading to the bursting of previous bubbles has been 40%-50%, as was the case in the U.S. from 2002-2007, in South Korea in the mid-90s and in Japan in the late 80s. China’s credit growth has been by far higher than all of those. Now, we see all the signs one usually sees before the bubble bursts. For instance:

– Large expansion and acceleration of credit not matched by GDP, as credit growth is still 2.5 times faster than GDP but slowing.

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

Re: Financial topics

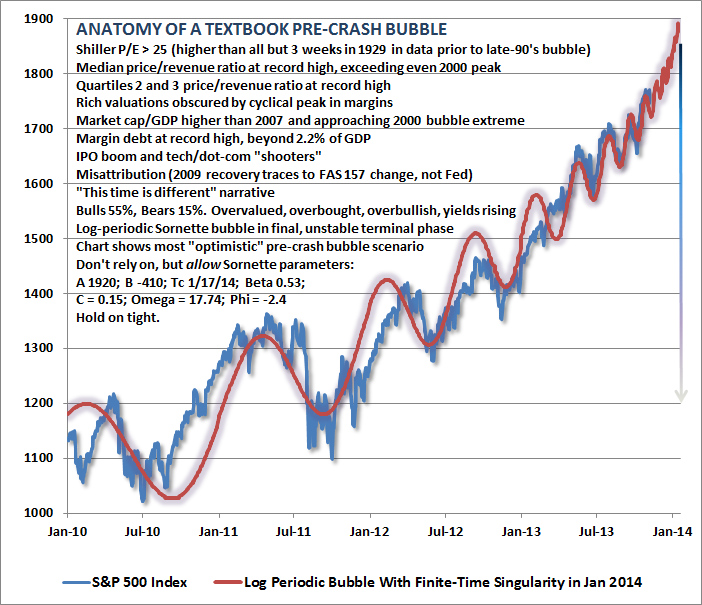

vincecate wrote:The news hussman article is out and he also talks about patterns for the setup of a crash or bear market:

http://www.hussmanfunds.com/wmc/wmc140217.htm

Re: Financial topics

This the the S&P without the log periodic graph on top:

Re: Financial topics

Lipper's fund-tracking data. Investors returned money to equity funds in the latest week, adding nearly $6.9 billion in the period ended February 12, but that pales in comparison to the more than $22 billion yanked from stock funds over the previous two weeks.

In another bearish sign, margin debt hit its fourth straight monthly record in December at $444.93 billion, according to Thomson Reuters data, a factor that has historically preceded market pullbacks, including shortly before the pre-financial crisis top in July 2007.

http://www.reuters.com/article/2014/02/ ... L320140217

Ecological Deficits will announce itself faster than paper tigers hubris.

http://www.ncregister.com/daily-news/ar ... -republic/

http://www.theblaze.com/contributions/w ... llennials/ Out of this smoke there came a swarm of locusts

In another bearish sign, margin debt hit its fourth straight monthly record in December at $444.93 billion, according to Thomson Reuters data, a factor that has historically preceded market pullbacks, including shortly before the pre-financial crisis top in July 2007.

http://www.reuters.com/article/2014/02/ ... L320140217

Ecological Deficits will announce itself faster than paper tigers hubris.

http://www.ncregister.com/daily-news/ar ... -republic/

http://www.theblaze.com/contributions/w ... llennials/ Out of this smoke there came a swarm of locusts

Re: Financial topics

Just as an anterior thought maybe the economy will run at 95 to 98.5% as employments

does slow. Debasement indeed does not solve anything just as energy poverty asserts itself

does not either perk up the landscape. I am not overly optimistic either that Goldilocks will appear

soon given the pounding liberal blather all is what they want. Not easy since that is never a given

when the sun comes up.

does slow. Debasement indeed does not solve anything just as energy poverty asserts itself

does not either perk up the landscape. I am not overly optimistic either that Goldilocks will appear

soon given the pounding liberal blather all is what they want. Not easy since that is never a given

when the sun comes up.

-

Higgenbotham

- Posts: 8127

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

Hypothetical question and answer between an 8 year old child and an adult who invests or trades in the stock market (or, are we really smarter than a third grader?)

Q: You said there was a bubble before I was born. What was the bubble in?

A: It was in the Internet stocks, or the high tech stocks.

Q: Oh, is that the S&P 500 thing you always talk about?

A: No, the high tech stocks are the Nasdaq stocks.

Q: What's the thing for the high tech stocks, then?

A: That's called the Nasdaq Composite.

Q: Why don't you talk about that one instead, since you're always talking about bubbles?

A: Um, I don't know, I guess it's because you can't trade the Nasdaq Composite because it's just an index.

Q: I saw on TV that the stocks hit new record highs, did that Nasdaq, the one the bubble was in hit a record too?

A: No.

Q: Could you draw a chart of that one and show it to me?

A: OK. (To be continued)

Q: You said there was a bubble before I was born. What was the bubble in?

A: It was in the Internet stocks, or the high tech stocks.

Q: Oh, is that the S&P 500 thing you always talk about?

A: No, the high tech stocks are the Nasdaq stocks.

Q: What's the thing for the high tech stocks, then?

A: That's called the Nasdaq Composite.

Q: Why don't you talk about that one instead, since you're always talking about bubbles?

A: Um, I don't know, I guess it's because you can't trade the Nasdaq Composite because it's just an index.

Q: I saw on TV that the stocks hit new record highs, did that Nasdaq, the one the bubble was in hit a record too?

A: No.

Q: Could you draw a chart of that one and show it to me?

A: OK. (To be continued)

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

-

Higgenbotham

- Posts: 8127

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

Q: OK, I see it. When that bubble popped, how far down did it go?

A: It went from 5132 to 1108 and you still weren't born yet.

Q: Wow. What did it do after it got to 1108?

A: It went up for a few months, then it came back down to 1253. Then it went up until 2007, after you were born. Then it came back down.

Q: Where did it come back down to?

A: In 2009 it made another low at 1265.

Q: Wow, so it went up and down thousands of points, but when it came back down it stopped only 12 points from the low it made in 2003?

A: Yeah, I guess that's right. I never noticed that before.

Q: Hey, I think I can do this stock market analysis thing. Look, when it went up to the 2007 high just after I was born, it went to 2861 and it stopped 31 points from the high it made in 2001. That was 2892. Could you have shorted there?

A: Um, I guess you're right about that. I never noticed that before either. My MACD and stochastics and various indicators didn't tell me that.

Q: I see something like what happened in 2007 now. It got to 4250 on Friday and it's only 9 and 38 points from the highs made near the end of 2000. That's pretty close to 12 and 31 like it did before. Do you think I could go on CNBC as a stock market analyst and talk about this instead of going to college?

A: Maybe you could.

A: It went from 5132 to 1108 and you still weren't born yet.

Q: Wow. What did it do after it got to 1108?

A: It went up for a few months, then it came back down to 1253. Then it went up until 2007, after you were born. Then it came back down.

Q: Where did it come back down to?

A: In 2009 it made another low at 1265.

Q: Wow, so it went up and down thousands of points, but when it came back down it stopped only 12 points from the low it made in 2003?

A: Yeah, I guess that's right. I never noticed that before.

Q: Hey, I think I can do this stock market analysis thing. Look, when it went up to the 2007 high just after I was born, it went to 2861 and it stopped 31 points from the high it made in 2001. That was 2892. Could you have shorted there?

A: Um, I guess you're right about that. I never noticed that before either. My MACD and stochastics and various indicators didn't tell me that.

Q: I see something like what happened in 2007 now. It got to 4250 on Friday and it's only 9 and 38 points from the highs made near the end of 2000. That's pretty close to 12 and 31 like it did before. Do you think I could go on CNBC as a stock market analyst and talk about this instead of going to college?

A: Maybe you could.

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

-

Higgenbotham

- Posts: 8127

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

-

Higgenbotham

- Posts: 8127

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

Who is online

Users browsing this forum: No registered users and 1 guest