Wednesday, December 21, 2022

vincecate wrote: Tue Dec 20, 2022 10:22 am

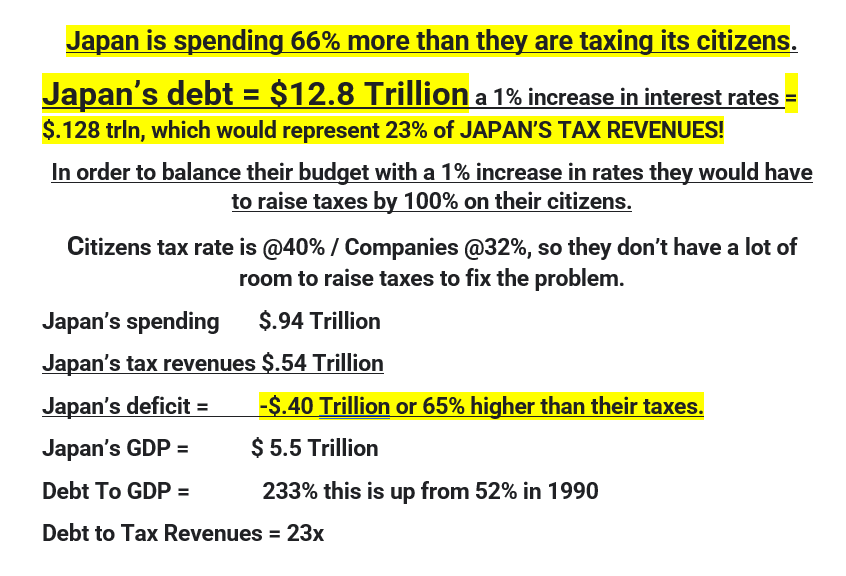

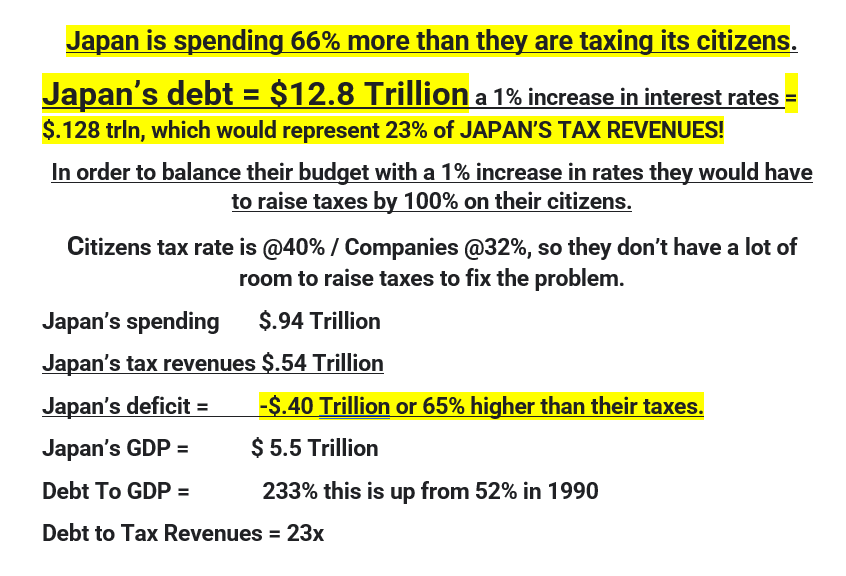

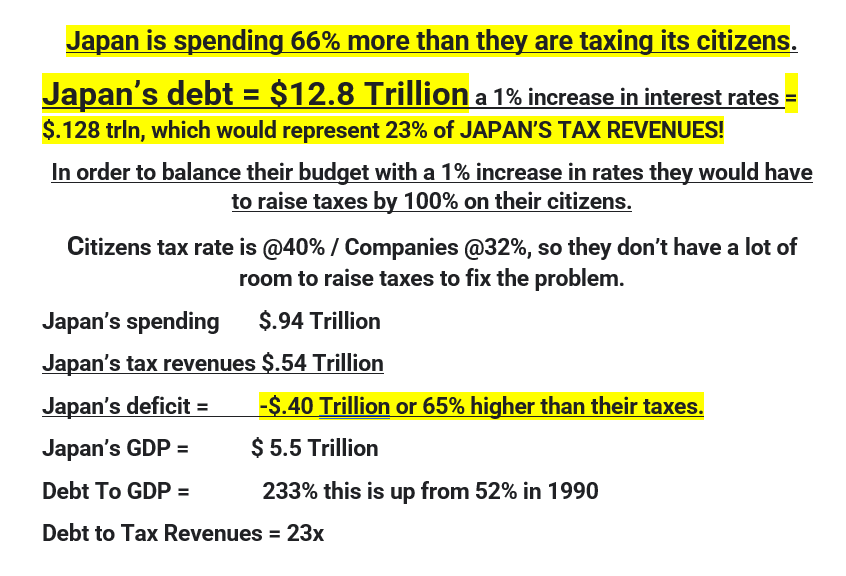

So Japan is letting 10 year rates go from 0.25% up to 0.50% but they are also printing money and buying bonds faster than ever. This looks to me like the start of the runaway feedback loop. The faster they print the faster people should dump bonds. The faster people dump bonds the faster they will print. Don't know if this is weeks or months or more than a year still, but I think the market players will see this as finally the right time to get short on JGBs. I think the BOJ can not keep things under control much longer. The last 40 years shorting JGBs was "the widow maker trade" but I expect it is profitable over the next 5 years. I think it is blood in the water time.

Wednesday, December 21, 2022

so the big news all day yesterday was that the Bank of Japan has doubled the top interest rate on the 10-year bond. The interesting thing is that all the analysts seem to be completely baffled by what's going on. some think it is a good move, some think it's a bad move. some think it's a one-off move. others think it's the first of a series of moves. some think it shows the path for the fed to follow, while others think that the Fed should take the opposite approach. it's been a really bad day for the mainstream analysts.

as usual, the mainstream analysts are confused or wrong because they miss the obvious generational issues. The people in Japan are 10 years ahead of the west. the people in the west's major financial crisis began in 1929, while Japan's major financial crisis began in 1919.

Japan had another major financial crisis again in 1990, and the west had one 10 years later in 2000.

here is a graph that I posted in 2007:

Japan's real estate crash may finally end after 16 years

http://www.generationaldynamics.com/pg/ ... 070220.htm

so if mainstream analysts are completely baffled by what the Bank of Japan is doing, it may be because they're trying to compare the Bank of Japan to the Fed, when the two are completely incomparable because they're at different points on their respective timelines. timelines. I don't know how to relate Japan's timeline to America's timeline, but one possibility is that Japan's actions are predicting what the Fed would have to do 10 years from now. at any rate, I believe this would be an extremely fruitful area of research.

mainstream economists are making a similar mistake by comparing the economy today to the economy in the 1970s, although the two are completely uncomfortable for reasons I've stated many times in the past . once again, this would be an extremely fruitful area of research, if anyone were interested.