Page 2847 of 2984

Re: Financial topics

Posted: Thu Jul 28, 2022 9:48 pm

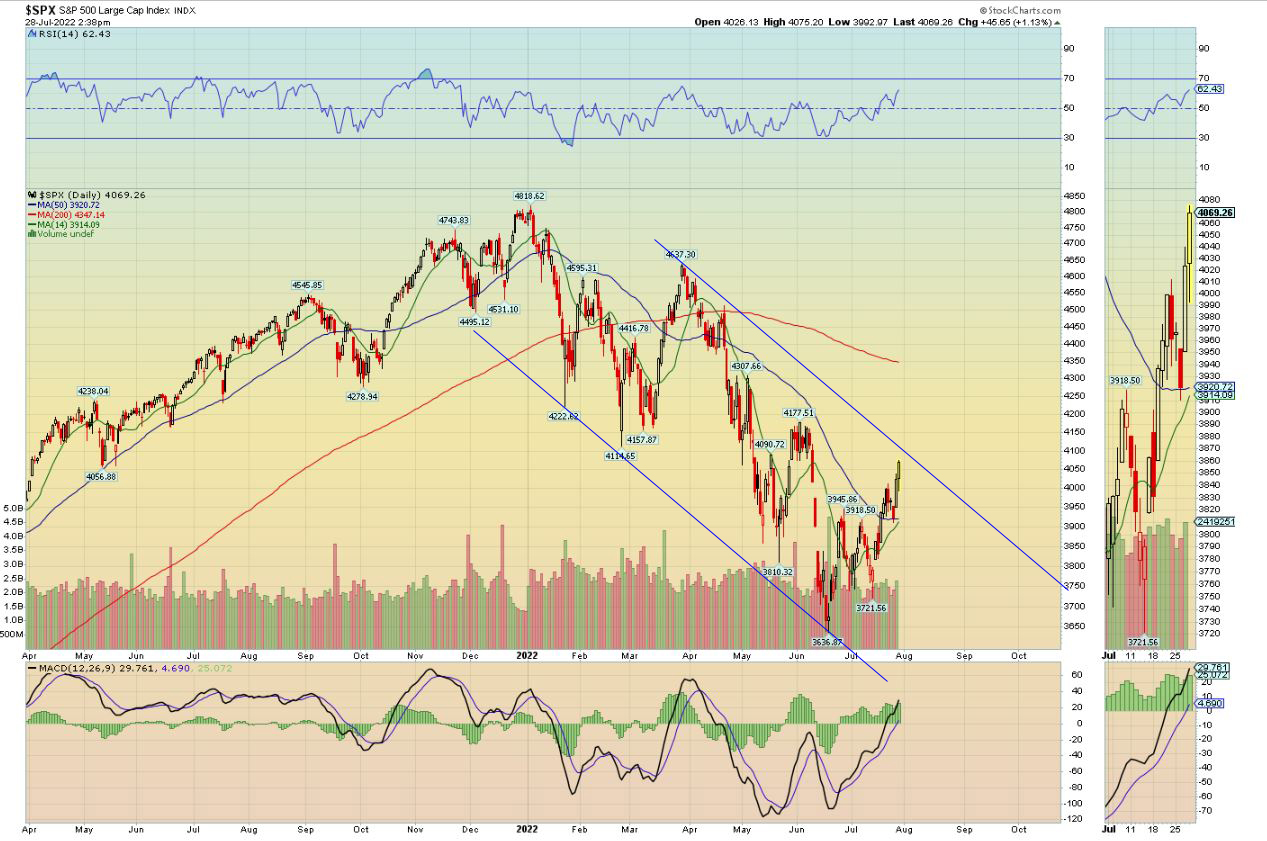

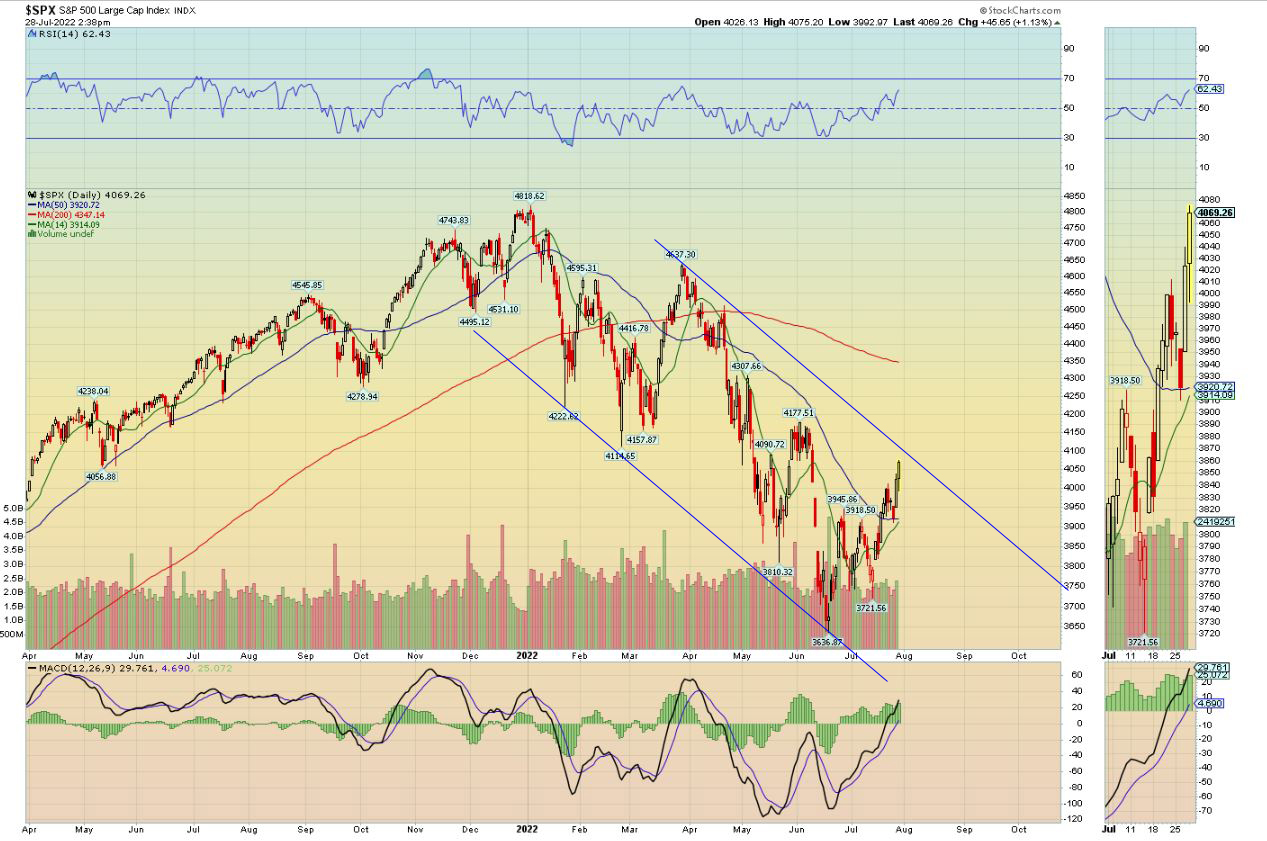

by Phong Tran

Think this image says it all. The bulls seem to be very happy as if they've broken through, but they've only reached the top of this trendline, even with the after market action, if they can get above it and hold then we might be in for another month or two of corrective action. If they can't, well, guess we'll see what the next two trading days bring.

Re: Financial topics

Posted: Thu Jul 28, 2022 11:11 pm

by Tom Mazanec

vincecate wrote: Thu Jul 28, 2022 8:34 pm

The negative real rates have given us an all time low in the Financial Stress Index:

https://fred.stlouisfed.org/graph/?graph_id=1004739

I really don't think they are effectively fighting inflation yet. They rush to drop rates and are so slow to increase them. Inflation is going up faster than rates are. The CPI at 9.1% and they just moved rates from 1.75% to 2.5%. In the past to fix inflation interest rates had to get higher than the inflation rate. At the pace they are going they will never get there.

And interest has to be higher than the

actual inflation rate, not the phony one the government publishes.

Re: Financial topics

Posted: Fri Jul 29, 2022 8:54 am

by richard5za

Phong Tran wrote: Thu Jul 28, 2022 9:48 pm

.... even with the after market action, if they can get above it and hold then we might be in for another month or two of corrective action. If they can't, well, guess we'll see what the next two trading days bring.

Phong, bear markets that are accompanied by a recession tend to be long drawn out affairs, quite different to non-recessionary bear market corrections.

I don't think that the market will bottom this year; my current view (based upon my own fuzzy maths) is January 2023 at the earliest but more probably mid 2023 for the market bottom

Re: Financial topics

Posted: Fri Jul 29, 2022 9:01 am

by richard5za

vincecate wrote: Thu Jul 28, 2022 8:34 pm

The negative real rates have given us an all time low in the Financial Stress Index:

https://fred.stlouisfed.org/graph/?graph_id=1004739

I really don't think they are effectively fighting inflation yet. They rush to drop rates and are so slow to increase them. Inflation is going up faster than rates are. The CPI at 9.1% and they just moved rates from 1.75% to 2.5%. In the past to fix inflation interest rates had to get higher than the inflation rate. At the pace they are going they will never get there.

Vince, I am trying to figure out why the Financial Stress Index is important and why it should be low because of negative real interest rates. The average person must feel under attack first with high inflation and now rising interest rates on debt that is much too high because of the previously ridiciously low interest rates.

I suspect lots of politics in play on the interest rates with the mid terms just around the corner

Re: Financial topics

Posted: Fri Jul 29, 2022 9:07 am

by richard5za

Higgenbotham wrote: Thu Jul 28, 2022 8:23 pm

Higgenbotham wrote: Tue Jun 14, 2022 4:21 pm

This is the 11th trading day since the May 27 close and there were recently 3 gap down days. The bears will press their luck but I am not short. That's not to say the market won't fall further. I have no idea. But the easy part of the down move by my reckoning is over.

I started to go short today near 4100 before and after the cash close (the market exploded higher after the cash close). That may be the final burst higher but I kind of doubt it. I will add some if the market gets near 4200 and 4300.

Higgie, I have also now gone short, and will add to the shorts as appropriate. As you say the market may rally up a bit, and for a couple of weeks, but the probability is down quite a long way. At some point boomers, who own a lot of the market will get concerned about their retirement and then panic and that will seal the down trend.

Re: Financial topics

Posted: Fri Jul 29, 2022 11:07 am

by aeden

https://www.natlawreview.com/article/ne ... y-industry <--------

Staffing is issue. One I know suffered heat stroke on a a rig. Hes done, a good man. Metabolism permantly effected.

Covid was devastating on many still inder long term real time care.

The start up will run another 36 months and licensed technicians are past value maps currently ignored as is data base fetch packet issues.

Another crush injury and burn out rampant. We have shifted critical functions to terms early as not to back load current critical maps

for frequency of failure preventive measures Sogo Shosha maps still lacking cogent integration but is improving.

They are adding up to real terms as the digitards find out food does not come from super markets also.

Lap top liberals are clueless as the wasting gains traction. I consider traction considerations as before will be ignored.

Our indicators are hang on the calvary is not coming as we noted early also. It does not matter if you understand since

your decades late already.

Book four as noted in 40xx 41xx maps are presorts as indicated. The drill downs forwarded are providing adequate cash

flow for next augmentations seen for risk premium.

No they do not understand life under the margin in the body farm swamp waste streams.

https://finviz.com/screener.ashx?v=111& ... 20_pa&ft=4

Re: Financial topics

Posted: Fri Jul 29, 2022 12:56 pm

by aeden

https://www.youtube.com/watch?v=R7gAEkzIgvw They are truly insane and yes

they are after you. Wake the hell up swamp the hour is late.

Your rhetoric is over as you embrace this evil.

Re: Financial topics

Posted: Fri Jul 29, 2022 3:17 pm

by Higgenbotham

Re: Financial topics

Posted: Fri Jul 29, 2022 5:05 pm

by Phong Tran

richard5za wrote: Fri Jul 29, 2022 8:54 am

Phong, bear markets that are accompanied by a recession tend to be long drawn out affairs, quite different to non-recessionary bear market corrections.

I don't think that the market will bottom this year; my current view (based upon my own fuzzy maths) is January 2023 at the earliest but more probably mid 2023 for the market bottom

Based on my previous projections, January 2023 would have been my first approximation of an interim market bottom as well. A good 40% off from top to bottom. My initial line of thinking for an August downturn was that the democrats would want a rising market into the mid term elections, so downturn in Aug-Sep and then another bear market rally into Sep-Oct. Can't see them trying to win an election when a market crash is fresh in the minds of everyone, and also don't see how the markets would just gyrate for another 4 months.

What would be the rationale for bear markets with a recession being more drawn out then non-recessionary? Wouldn't bear markets with a recession have a lower velocity of money and therefore less discretionary spending and less dip buyers?

Re: Financial topics

Posted: Fri Jul 29, 2022 9:44 pm

by vincecate

Powell claims 2.5% interest is the neutral rate when the fake CPI is 9.1% and real is probably 13+%.

The question is, is he lying or stupid? In general stupidity really does explain most things, but as the head of the Federal reserve and in charge of "stable prices" it can't be ignorance.

https://www.bloomberg.com/news/articles ... #xj4y7vzkg