https://www.natlawreview.com/article/ne ... y-industry <--------

Staffing is issue. One I know suffered heat stroke on a a rig. Hes done, a good man. Metabolism permantly effected.

Covid was devastating on many still inder long term real time care.

The start up will run another 36 months and licensed technicians are past value maps currently ignored as is data base fetch packet issues.

Another crush injury and burn out rampant. We have shifted critical functions to terms early as not to back load current critical maps

for frequency of failure preventive measures Sogo Shosha maps still lacking cogent integration but is improving.

They are adding up to real terms as the digitards find out food does not come from super markets also.

Lap top liberals are clueless as the wasting gains traction. I consider traction considerations as before will be ignored.

Our indicators are hang on the calvary is not coming as we noted early also. It does not matter if you understand since

your decades late already.

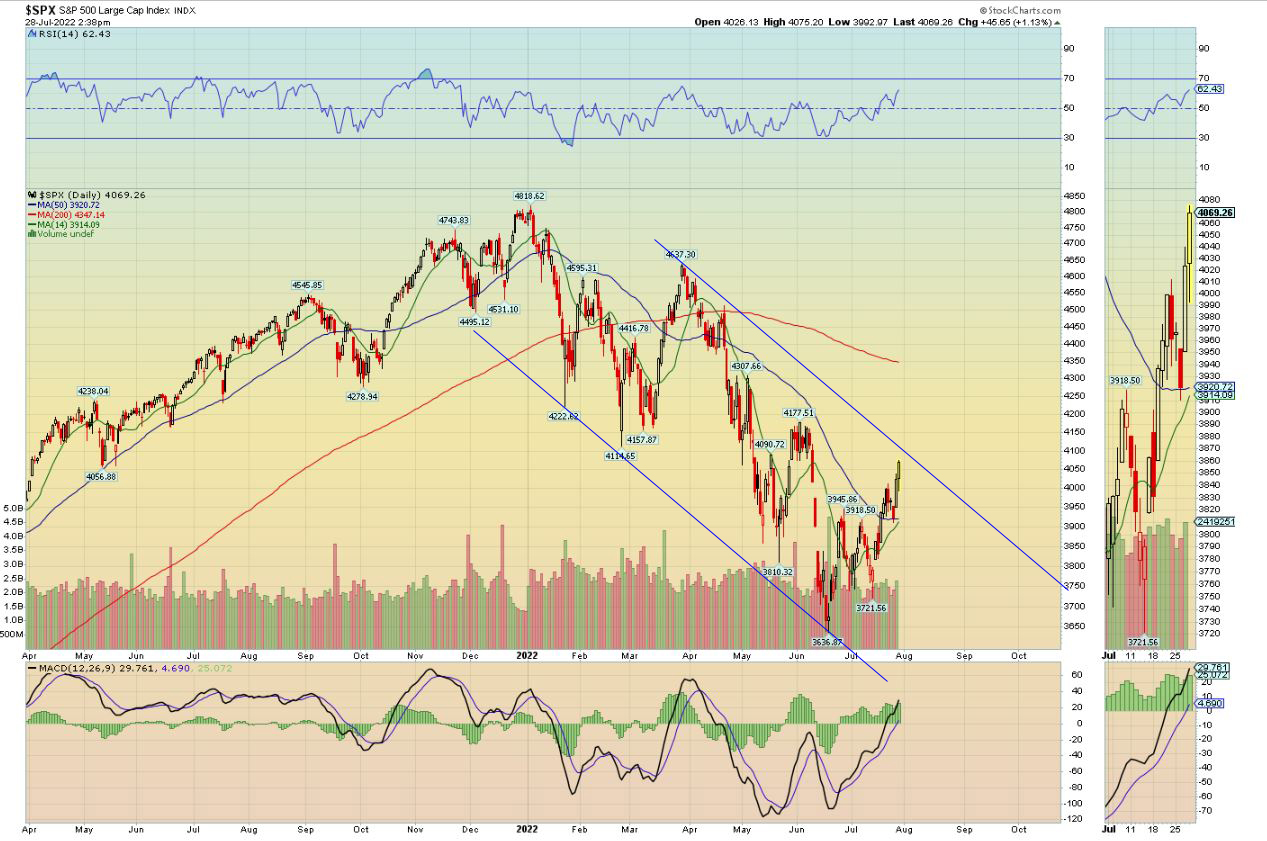

Book four as noted in 40xx 41xx maps are presorts as indicated. The drill downs forwarded are providing adequate cash

flow for next augmentations seen for risk premium.

No they do not understand life under the margin in the body farm swamp waste streams.

https://finviz.com/screener.ashx?v=111& ... 20_pa&ft=4