In both cases above the ratio moved higher quickly and reached an extreme after the S&P 500 had topped.

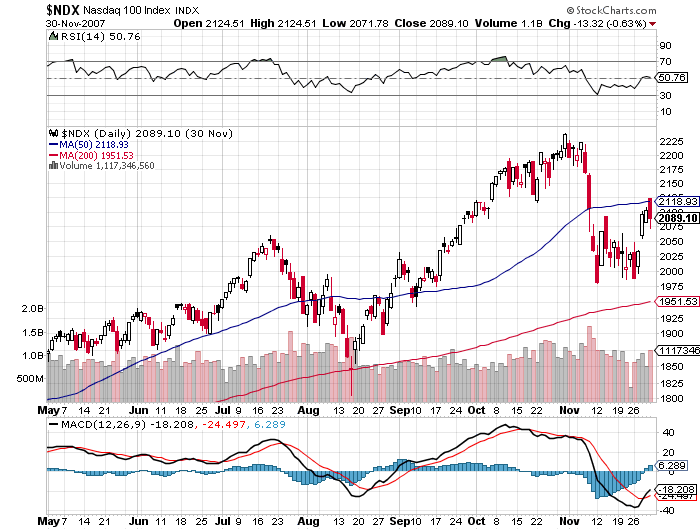

In the first case, the S&P 500 reached an all time high on October 11, 2007. After that, the S&P 500 fell for about 8 days, then rallied to within about 20 points of its all time high on October 31, 2007 and failed. Meanwhile, the Nasdaq 100 rallied to a new high, the same day, October 31, 2007, and that was the high that held for several years.

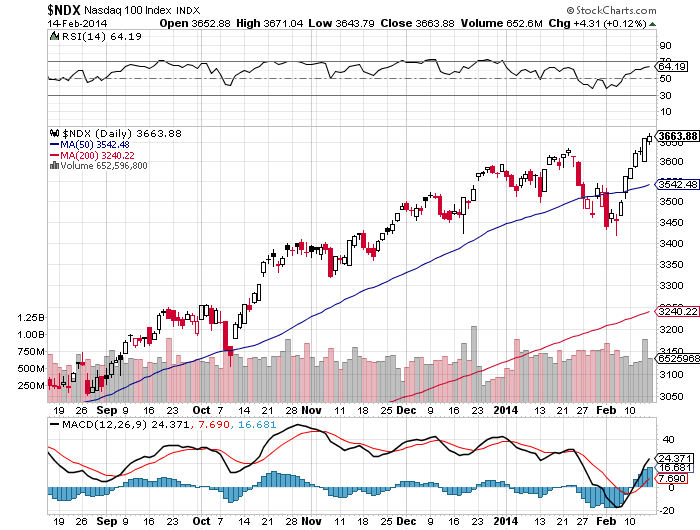

Similarly, the S&P 500 reached an all time high on January 15, fell for about 13 days, and has rallied back to near its all time high, while the Nasdaq 100 has in the meantime rallied to a new multi year high.

- NDX2007.png (22.53 KiB) Viewed 3058 times

- NDX2014.png (22.56 KiB) Viewed 3058 times

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.