Financial topics

Re: Financial topics

Japan's PPI is 9.3%

Interest rates still 0.2%

In Japan everyone should borrow, nobody should save, the velocity of money should go up, and inflation should go up more ...

https://www.investing.com/economic-calendar/ppi-35

Interest rates still 0.2%

In Japan everyone should borrow, nobody should save, the velocity of money should go up, and inflation should go up more ...

https://www.investing.com/economic-calendar/ppi-35

Re: Financial topics

Inputs stable. If we hit a air pocket on supply over the snow drift paradox status it is avarice the spur of greed.

Tier one and Tier two supply chains will slowly walk out the door which is death to communist regimes into fair trade areas.

They are puzzled how a free market works.

Offer peace with no malice to the afflicted to live in peace. Evil must be checked in place. It serves darkness only

no matter who you are. The woke Uniparty manipulated are the fact of the matter.

A collapse is no. Stupidity will continue. Just because they are decieved does not change your responsibilities.

About time the Democrats figure this out. Or go Independant to survive the Keys to this Blood again.

Regulators must press requirements for more private company disclosures, and who are new owners and other investors to which the company management report to. Senate must wake to fact who is now what for some time.

Secondary buyouts were among the top deal types expected in the coming months,

according to the results of a recent Datasite survey of more than 540 global dealmakers.

I think Gabbard Hit on a point what and who worship no winners.

100 Billion last spot check to private ownership. Woke is dead in its tracks. They are evil.

In recent years, left-wing extremists have sabotaged and attacked far more buildings in the United States than anyone else has.

And to be honest, it could just as easily be a foreign terror group or intelligence agents from a hostile country.

At this point, we just don’t know. tyler

This much I do know reported earlier leftists with gas cans for Forrest fires and poles cut over halfway to allow them to break in

wind events is fact from these idiots.

https://capitalresearch.org/article/woke-twitter/ If you ignore the Agency Issue you are the issue.

On a view we alone carry we know they serve darkness.

We should expect to see the Confucius Institutes try to return to the United States as some point, likely using the new management as a reason to present themselves as new institutes—something different than they once were. Alternatively, China will attempt to influence the U.S. in other ways. https://capitalresearch.org/article/the ... nstitutes/

A more recent attempt has seemingly been the purchase of farmlands near U.S. military bases. Whatever a strategies China employs, the Confucius Institutes should be forgotten or ignored.

Protect and defend these United States - except this one named Biden as thousands upon thousands invade the Borders. Criminal.

The end goal of the Cloward-Piven strategy is the creation of a political crisis.

Tier one and Tier two supply chains will slowly walk out the door which is death to communist regimes into fair trade areas.

They are puzzled how a free market works.

Offer peace with no malice to the afflicted to live in peace. Evil must be checked in place. It serves darkness only

no matter who you are. The woke Uniparty manipulated are the fact of the matter.

A collapse is no. Stupidity will continue. Just because they are decieved does not change your responsibilities.

About time the Democrats figure this out. Or go Independant to survive the Keys to this Blood again.

Regulators must press requirements for more private company disclosures, and who are new owners and other investors to which the company management report to. Senate must wake to fact who is now what for some time.

Secondary buyouts were among the top deal types expected in the coming months,

according to the results of a recent Datasite survey of more than 540 global dealmakers.

I think Gabbard Hit on a point what and who worship no winners.

100 Billion last spot check to private ownership. Woke is dead in its tracks. They are evil.

In recent years, left-wing extremists have sabotaged and attacked far more buildings in the United States than anyone else has.

And to be honest, it could just as easily be a foreign terror group or intelligence agents from a hostile country.

At this point, we just don’t know. tyler

This much I do know reported earlier leftists with gas cans for Forrest fires and poles cut over halfway to allow them to break in

wind events is fact from these idiots.

https://capitalresearch.org/article/woke-twitter/ If you ignore the Agency Issue you are the issue.

On a view we alone carry we know they serve darkness.

We should expect to see the Confucius Institutes try to return to the United States as some point, likely using the new management as a reason to present themselves as new institutes—something different than they once were. Alternatively, China will attempt to influence the U.S. in other ways. https://capitalresearch.org/article/the ... nstitutes/

A more recent attempt has seemingly been the purchase of farmlands near U.S. military bases. Whatever a strategies China employs, the Confucius Institutes should be forgotten or ignored.

Protect and defend these United States - except this one named Biden as thousands upon thousands invade the Borders. Criminal.

The end goal of the Cloward-Piven strategy is the creation of a political crisis.

-

Cool Breeze

- Posts: 2960

- Joined: Sun Jul 26, 2020 10:19 pm

Re: Financial topics

What are we looking at this week, another 7% print? I think they are going to be surprised it isn't as low as predicted.vincecate wrote: ↑Sun Dec 11, 2022 11:08 pmJapan's PPI is 9.3%

Interest rates still 0.2%

In Japan everyone should borrow, nobody should save, the velocity of money should go up, and inflation should go up more ...

https://www.investing.com/economic-calendar/ppi-35

Re: Financial topics

Even if its flat and not under four percent its not good.

https://cms.zerohedge.com/s3/files/inli ... k=9_Kjt_w0 <-------------------

Market prices results. Theta carry is going to be vaporised.

H was right again to limit it or none.

Gas on the fire and as put - only a retard still believes our financial system is not only solvent, but a workable,

and sustainable in the long term. Capitalism was rapacious, and funneled money upwards. tyler

The funds are part of $80 billion for multi-employer pension funds included in the American Rescue Plan, which was approved in 2021 to help stave off the fiscal impact of the COVID-19 pandemic. Some of those funds will be used to shore up the Teamsters' Central States Pension Fund, which includes employees and retires in more than 1,000 companies.

Fri Dec 09, 2022 10:52 am

I can understand the dissonance think its better this quarter. It is not on a local or state level for now.

The swamp has lost its mind as more simply feel they are just abject relegated captivated fools.

We seen the segment when wages and nominal productivety separated.

https://www.epi.org/productivity-pay-gap/

Remember some of us lived in a gold standard and are not gold bricks and do know the Senate are captivated

and went over the wire.

Since the https://www.federalreservehistory.org/e ... -agreement they just looted

No free lunch unless your the criminal juice box straw class as - We are all Keynesians now is a phrase attributed to Milton Friedman

and later rephrased by U.S. president Richard Nixon.

Report out shows US Household Wealth Sees Second-Fastest Decline in US History in 2022 Under Joe Biden and the Demsheviks.

if/then uvxy @6.99 I will get some is the risk on map only into a flat 2023. Fri Dec 09, 2022 10:52 am

No i did not carry theta and selct shorts as noted opened and closed. Puts may come in, not today.

Teir one and Tier two assets will be re classified. It was put mind your Business. Now they do not like it.

Sogo lines are fine for now and the yes we restocked for our independant needs.

Over all out side the Dollar system they will wipe you clean to preserve a lower tier reality.

Snow Drift Paradox is on you. Senate needs to wake up for base load energy facts not lead by the nose as captivated fools.

https://cms.zerohedge.com/s3/files/inli ... k=9_Kjt_w0 <-------------------

Market prices results. Theta carry is going to be vaporised.

H was right again to limit it or none.

Gas on the fire and as put - only a retard still believes our financial system is not only solvent, but a workable,

and sustainable in the long term. Capitalism was rapacious, and funneled money upwards. tyler

The funds are part of $80 billion for multi-employer pension funds included in the American Rescue Plan, which was approved in 2021 to help stave off the fiscal impact of the COVID-19 pandemic. Some of those funds will be used to shore up the Teamsters' Central States Pension Fund, which includes employees and retires in more than 1,000 companies.

Fri Dec 09, 2022 10:52 am

I can understand the dissonance think its better this quarter. It is not on a local or state level for now.

The swamp has lost its mind as more simply feel they are just abject relegated captivated fools.

We seen the segment when wages and nominal productivety separated.

https://www.epi.org/productivity-pay-gap/

Remember some of us lived in a gold standard and are not gold bricks and do know the Senate are captivated

and went over the wire.

Since the https://www.federalreservehistory.org/e ... -agreement they just looted

No free lunch unless your the criminal juice box straw class as - We are all Keynesians now is a phrase attributed to Milton Friedman

and later rephrased by U.S. president Richard Nixon.

Report out shows US Household Wealth Sees Second-Fastest Decline in US History in 2022 Under Joe Biden and the Demsheviks.

if/then uvxy @6.99 I will get some is the risk on map only into a flat 2023. Fri Dec 09, 2022 10:52 am

No i did not carry theta and selct shorts as noted opened and closed. Puts may come in, not today.

Teir one and Tier two assets will be re classified. It was put mind your Business. Now they do not like it.

Sogo lines are fine for now and the yes we restocked for our independant needs.

Over all out side the Dollar system they will wipe you clean to preserve a lower tier reality.

Snow Drift Paradox is on you. Senate needs to wake up for base load energy facts not lead by the nose as captivated fools.

Re: Financial topics

CPI ESTIMATES FOR TOMORROWCool Breeze wrote: ↑Mon Dec 12, 2022 1:41 pmWhat are we looking at this week, another 7% print? I think they are going to be surprised it isn't as low as predicted.

CREDIT SUISSE 7.2%

BARCLAYS 7.2%

BLOOMBERG 7.2%

JEFFERIES 7.2%

CITI 7.2%

MORGAN STANLEY 7.2%

WELLS FARGO 7.2%

NOMURA 7.2%

GOLDMAN 7.2%

BMO 7.3%

CIBC 7.3%

JP MORGAN 7.3%

GURGAVIN CAPITAL 7.3%

TD SECURTIES 7.3%

SCOTIABANK 7.4%

MEDIAN 7.3%

Cleveland Fed has 7.49%. They have been low much more than high this past year but closer than most I think.

A 7.5% or higher should shake the markets faith in transitory.

https://www.clevelandfed.org/indicators ... nowcasting

Last edited by vincecate on Mon Dec 12, 2022 9:08 pm, edited 2 times in total.

Re: Financial topics

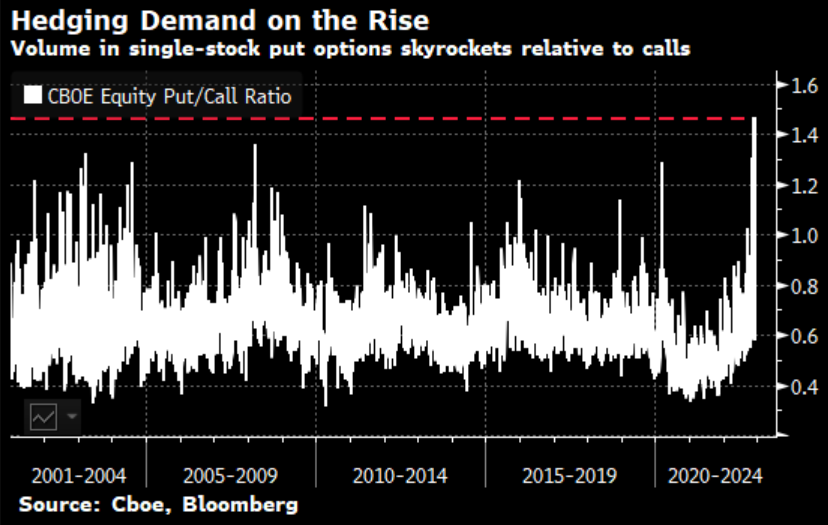

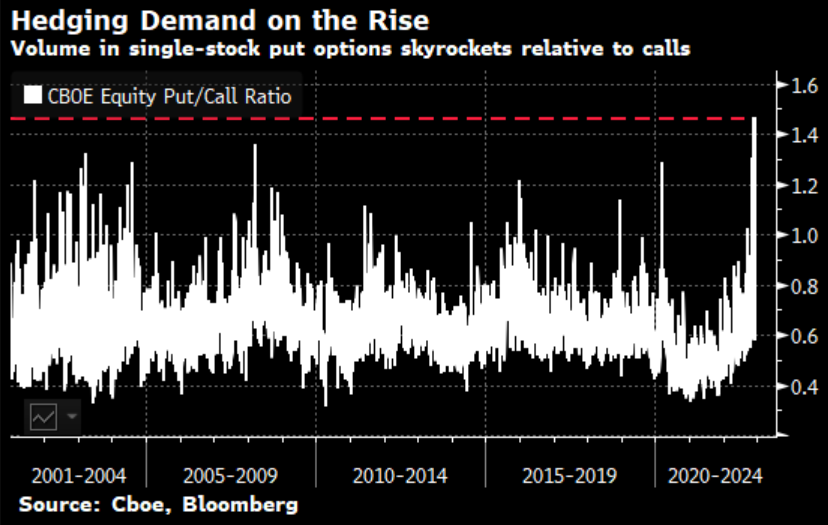

Seems single stock put/call ratio is the highest in at least 21 years. Hum.

Re: Financial topics

They mentioned this week would be a spectacle. I sold modest into the close.

Stock options are derivative contracts that give the buyer the right (not obligation) to buy (call option) or sell (put option)

a determined quantity of stocks at a specified price (strike price).

These contracts expire after some time, unlike equities that, unless the company is bankrupt,

merged, or bought by some other company, have theoretically an infinite life.

The plunder economy was unsustainable — once the empire's conquests ceased and invaders from beyond their borders began to pick off colonies.

States will be crushed from the current regime since it is the plan.

Read More: https://www.grunge.com/129687/messed-up ... paign=clip

https://putcallratio.org/ nothing to get hung about

...today's market action had a feel of anxiety, FOMO, and low liquidity about it.

.... last week you knew this ....

Stock options are derivative contracts that give the buyer the right (not obligation) to buy (call option) or sell (put option)

a determined quantity of stocks at a specified price (strike price).

These contracts expire after some time, unlike equities that, unless the company is bankrupt,

merged, or bought by some other company, have theoretically an infinite life.

The plunder economy was unsustainable — once the empire's conquests ceased and invaders from beyond their borders began to pick off colonies.

States will be crushed from the current regime since it is the plan.

Read More: https://www.grunge.com/129687/messed-up ... paign=clip

https://putcallratio.org/ nothing to get hung about

...today's market action had a feel of anxiety, FOMO, and low liquidity about it.

.... last week you knew this ....

Re: Financial topics

It took 31 days but they finally arrested SBF.

They charged him with:

1. Wire Fraud

2. Wire Fraud Conspiracy

3. Securities Fraud

4. Securities Fraud Conspiracy

5. Money Laundering

This should put a chill on all the other cryptos than Bitcoin. Bitcoin is the only one that people agree is not a security.

They charged him with:

1. Wire Fraud

2. Wire Fraud Conspiracy

3. Securities Fraud

4. Securities Fraud Conspiracy

5. Money Laundering

This should put a chill on all the other cryptos than Bitcoin. Bitcoin is the only one that people agree is not a security.

Re: Financial topics

Good news.

Vin the current trend favors the puts.

Why...

Waiting for the Golden-Cross..... never has it failed to announce the Bears hibernation

for if/then to because/then. All know here the golden cross facts over multi decades.

Pols must triangulate to survive, Swamp went a bridge to far. They know it.

Red pill or blue pill media gaslighters must be sent packing.

Vin the current trend favors the puts.

Why...

Waiting for the Golden-Cross..... never has it failed to announce the Bears hibernation

for if/then to because/then. All know here the golden cross facts over multi decades.

Pols must triangulate to survive, Swamp went a bridge to far. They know it.

Red pill or blue pill media gaslighters must be sent packing.

Re: Financial topics

Blackrock's highest conviction is that long term government bonds are a bad investment. I agree.

https://www.bloomberg.com/news/articles ... -scenarios

https://www.bloomberg.com/news/articles ... -scenarios

Who is online

Users browsing this forum: No registered users and 121 guests