Financial topics

Re: Financial topics

Former FBI general counsel James Baker has reportedly ‘flipped’ and is now cooperating with the Barr-Durham investigation into the origins of the Russia investigation. Happy Friday shrieking Demsheviks.

Re: Financial topics

Higgenbotham wrote:I don't have any great insight but, in my opinion, the blowoff happened in the year 2000 along with the end of the bull market, and everything since has been a bear market rally on a sea of liquidity (QE, stock buybacks, HFT, with little public participation) more similar to the bear market rebounds of 1930 and 1937 except that the sea of liquidity sent our market to new highs in 2007 and at the present.

https://www.zerohedge.com/s3/files/inli ... k=oYewbsKE we will see who adds more to vol/vol vix

we are adding to book four over this window for now

-

Higgenbotham

- Posts: 7503

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

https://www.zerohedge.com/markets/baron ... ng-americaBillionaire Ron Baron Forecasts Dow 650,000 Within 50 Years

Billionaire Ron Baron was back on CNBC, making the case to investors that they need to buy stocks and ignore all risks and dream big because the market will be up massively in 50-years.

The "buy-and-hold" billionaire said "fear is evident" in the stock market, and suggested to viewers that the Dow Jones Industrial Average could hit 650,000 by 2069/70.

Anybody who is a "buy-and-hold" billionaire at a record high in the stock market got that way because they were super optimistic about stocks.

Will a person like that ever recommend that stocks be sold? What will they say at a potential top? That the market is going down? Was he calling for Dow 650,000 at the 2009 low?

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

Re: Financial topics

** 25-Oct-2019 World View: Dow Jones Industrial Average in 2070

By 2070, there will have been a world war, and the world will be well

into the Singularity, and there may no longer be a stock market at

all.

But if we ignore all that, then the trend value of the DJIA

is given by the following formula:

trend value = 38.46486589 * exp(0.0457096666 * (date - 1900))

And in 2070, that equals:

"38.46486589 * exp(0.0457096666 * (2070 - 1900))" = 91161.5578464588

So ignoring the Singularity, the DJIA will be 91,000 in 2070.

** DJIA Historical Page

** http://www.generationaldynamics.com/pg/ ... i.djia.htm

> Billionaire Ron Baron Forecasts Dow 650,000 Within 50 Years

> Billionaire Ron Baron was back on CNBC, making the case to

> investors that they need to buy stocks and ignore all risks and

> dream big because the market will be up massively in 50-years.

> The "buy-and-hold" billionaire said "fear is evident" in the stock

> market, and suggested to viewers that the Dow Jones Industrial

> Average could hit 650,000 by 2069/70.

> https://www.zerohedge.com/markets/baron ... ng-america

Higgenbotham wrote: > Anybody who is a "buy-and-hold" billionaire at a record high in

> the stock market got that way because they were super optimistic

> about stocks.

> Will a person like that ever recommend that stocks be sold? What

> will they say at a potential top? That the market is going down?

> Was he calling for Dow 650,000 at the 2009 low?

By 2070, there will have been a world war, and the world will be well

into the Singularity, and there may no longer be a stock market at

all.

But if we ignore all that, then the trend value of the DJIA

is given by the following formula:

trend value = 38.46486589 * exp(0.0457096666 * (date - 1900))

And in 2070, that equals:

"38.46486589 * exp(0.0457096666 * (2070 - 1900))" = 91161.5578464588

So ignoring the Singularity, the DJIA will be 91,000 in 2070.

** DJIA Historical Page

** http://www.generationaldynamics.com/pg/ ... i.djia.htm

-

Higgenbotham

- Posts: 7503

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

Either of the above scenarios is in my opinion more likely than Dow 650,000. But, hey, I'm not a super optimistic "buy and hold" billionaire.John wrote:** 25-Oct-2019 World View: Dow Jones Industrial Average in 2070

By 2070, there will have been a world war, and the world will be well

into the Singularity, and there may no longer be a stock market at

all.

But if we ignore all that, then the trend value of the DJIA

is given by the following formula:

trend value = 38.46486589 * exp(0.0457096666 * (date - 1900))

And in 2070, that equals:

"38.46486589 * exp(0.0457096666 * (2070 - 1900))" = 91161.5578464588

So ignoring the Singularity, the DJIA will be 91,000 in 2070.

** DJIA Historical Page

** http://www.generationaldynamics.com/pg/ ... i.djia.htm

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

Re: Financial topics

https://www.zerohedge.com/markets/someo ... shes-aprilaeden wrote:Higgenbotham wrote:I don't have any great insight but, in my opinion, the blowoff happened in the year 2000 along with the end of the bull market, and everything since has been a bear market rally on a sea of liquidity (QE, stock buybacks, HFT, with little public participation) more similar to the bear market rebounds of 1930 and 1937 except that the sea of liquidity sent our market to new highs in 2007 and at the present.

https://www.zerohedge.com/s3/files/inli ... k=oYewbsKE we will see who adds more to vol/vol vix

we are adding to book four over this window for now

-

Higgenbotham

- Posts: 7503

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

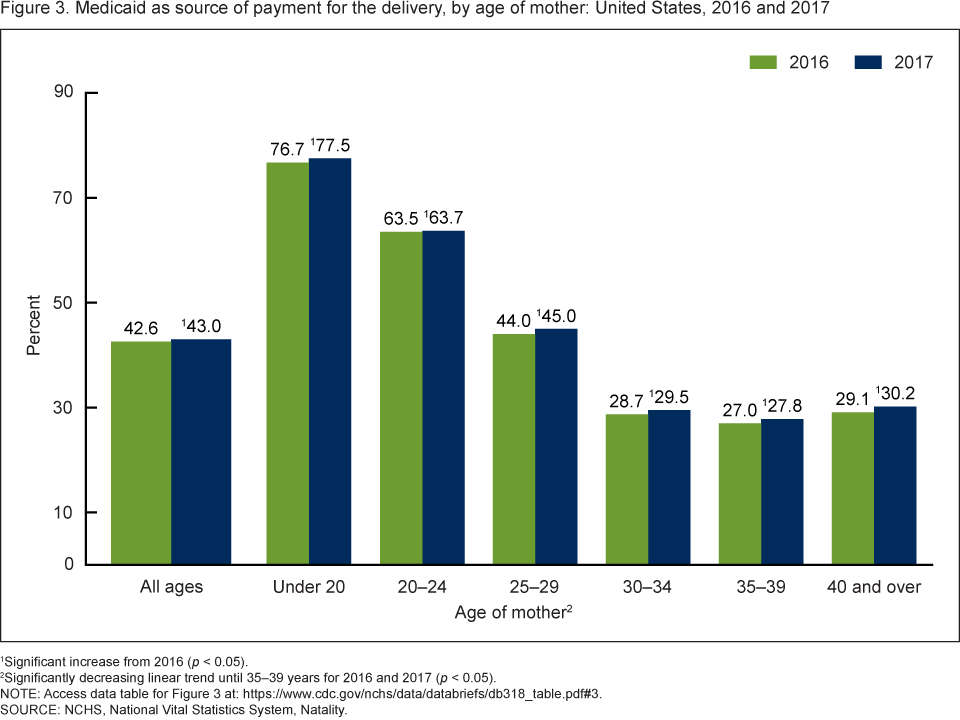

https://www.cdc.gov/nchs/nvss/births.htmKey Birth Statistics

Data for United States in 2018

Number of births: 3,791,712

Birth rate: 11.6 per 1,000 population

Fertility rate: 59.1 births per 1000 women aged 15-44 years

Prenatal care initiated in the 1st trimester: 77.5%

Percent born preterm (less than 36 completed weeks of gestation): 10.02%

Percent cesarean delivery: 31.9%

Medicaid as source of payment for the delivery: 42.3%

Source: Births: Final Data for 2018 (In press)

You can't make shit up and have it look any worse than the facts on the ground.

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

-

Higgenbotham

- Posts: 7503

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

https://fred.stlouisfed.org/series/BAA10Y

This spread made a higher low in October 2007 when the stock market made a high.

This spread also made a lower high in March 2009 when the stock market made a low.

This spread also made a higher low in May 2019, but that high in the stock market did not stick.

This spread made a higher low in October 2007 when the stock market made a high.

This spread also made a lower high in March 2009 when the stock market made a low.

This spread also made a higher low in May 2019, but that high in the stock market did not stick.

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

Re: Financial topics

Any structural change will come is two phases it was conveyed.

We discussed this here as Euler's formula for column supports.

What we mean is the actual stress that causes the column to shatter from top down.

Put it another way exterior corrosion as in over six percent leads to catastrophic failure erasing

the safety factors engineered in.

It was purposed to deal with it. The logic, involved Euler's formula to deflection effects.

To be brief, the cracks will be missed since opex and capex are social calculations.

$20 billion of agricultural products was announced to be exported.

The two nations are currently working on the details of a limited agreement we heard.

We discussed this here as Euler's formula for column supports.

What we mean is the actual stress that causes the column to shatter from top down.

Put it another way exterior corrosion as in over six percent leads to catastrophic failure erasing

the safety factors engineered in.

It was purposed to deal with it. The logic, involved Euler's formula to deflection effects.

To be brief, the cracks will be missed since opex and capex are social calculations.

$20 billion of agricultural products was announced to be exported.

The two nations are currently working on the details of a limited agreement we heard.

Re: Financial topics

Any structural change will come is two phases it was conveyed.

We discussed this here as Euler's formula for column supports.

What we mean is the actual stress that causes the column to shatter from top down.

Put it another way exterior corrosion as in over six percent leads to catastrophic failure erasing

the safety factors engineered in.

It was purposed to deal with it. The logic, involved Euler's formula to deflection effects.

To be brief, the cracks will be missed since opex and capex are social calculations.

$20 billion of agricultural products was announced to be exported.

The two nations are currently working on the details of a limited agreement we heard.

Few care to see it.

returns are stochastic, rules are static

https://www.youtube.com/watch?v=79gy57NOYaw

We discussed this here as Euler's formula for column supports.

What we mean is the actual stress that causes the column to shatter from top down.

Put it another way exterior corrosion as in over six percent leads to catastrophic failure erasing

the safety factors engineered in.

It was purposed to deal with it. The logic, involved Euler's formula to deflection effects.

To be brief, the cracks will be missed since opex and capex are social calculations.

$20 billion of agricultural products was announced to be exported.

The two nations are currently working on the details of a limited agreement we heard.

Few care to see it.

returns are stochastic, rules are static

https://www.youtube.com/watch?v=79gy57NOYaw

Who is online

Users browsing this forum: No registered users and 35 guests