3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group

Negative interest rates creating increased anxiety

** 3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group

** http://www.generationaldynamics.com/pg/ ... tm#e160803

Contents:

Iran furious at Palestinian meeting with Iran opposition group

Maryam Rajavi: Leader of the Mujahedin-e Khalq Organization (MEK or MKO)

Negative interest rates creating increased anxiety

Keys:

Generational Dynamics, Iran, Palestinian Authority, Mahmoud Abbas,

Maryam Rajavi, National Council of Resistance to Iran, NCRI,

Hossein Amir-Abdollahian, Mkhaimar Abusada, Hamas, Gaza,

Ayatollah Seyed Ali Khamenei, Iraq, Saddam Hussein,

Mujahedin-e Khalq Organization, MEK, MKO, Massoud Rajavi,

Syria, Bashar al-Assad, Ayatollah Rouhollah Khomeini,

Bill Gross, Fitch Ratings, Lisa Abramowicz

3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group / Negative interest rates

Re: 3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group / Negative interest rates

Hyperinflation will not happen as long as the velocity of money keeps going down, but it won't keep going down forever. When inflation starts going up everyone wants to buy real things as a hedge against inflation. And all those people that sold real things, they want to quickly buy real things too. Velocity of money is low now because interest rates and inflation are both low. When either of these pick up then the velocity of money will start going up.John wrote: As I've been writing for years, inflation or hyperinflation is not going to happen because the velocity of money keeps plummeting. ( "11-Mar-16 World View -- In desperation move, European Central Bank further lowers negative interest rates")

According to Abramowitz's contacts, the only thing that can stop the current plunge in bond yields is for some country to decide not to pay back their debt -- essentially to declare sovereign bankruptcy.

Inflation is a scary thing to bond holders. If you are holding a 20 bond and inflation starts going up you realize you might get 20 years of inflation before you get your money back and by then the money you get may not buy much. So when inflation picks up bond holders will head for the exits. Central banks will try to shore things up by buying bonds. Then you get a positive feedback loop of more inflation, more people getting out of bonds, and more central bank money printing, and more inflation. Once the feedback loop is triggered it is nearly impossible to stop. It becomes more powerful and inflation rate gets higher and higher.

Hyperinflation is how central bank foolishness ends. It has happened many times before in history. However, because it is a positive feedback loop, it comes on "all of a sudden" and the timing is probably not predictable. Just because inflation is tame now does not prove that central banks can print like crazy and still inflation will always stay low.

http://howfiatdies.blogspot.com/2014/08 ... ry-of.html

This is a great historical account of a French hyperinflation in sort of a blow by blow. The PDF is free.

https://mises.org/library/fiat-money-inflation-france

-

Coordinated fires

- Posts: 120

- Joined: Sat Jun 25, 2016 9:14 pm

- Location: Merica

Re: 3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group / Negative interest rates

Governments have been using (misusing?) monetary policy measures to prevent or mitigate the proper natural correction of malinvestments since the dot com bubble formed and then burst during the Greenspan years and the pattern has snowballed ever since. Every time a new asset bubble forms and then busts, the gov't attempts to prevent the necessary cyclical purge of malinvestments by either buying them directly or otherwise propping them up. Every time this occurs the bubbles grow and get worse as more of the growing supply of money finds its ways into stocks and investors begin to assume that govt bailouts or monetary easing will be there to save them if things go really bad.

One day it will not, and a massive purge of assets which have been overvalued for going on 20 years will occur. The spillover effect will of course be toxic to many entire asset classes, especially equities and other asset backed products, many assets will over-correct in the ensuing fire sale. I plan to bide my time until this occurs and then buy everything I can when there's blood in the streets. Procter & Gamble for 5 cents on the dollar anyone?

One day it will not, and a massive purge of assets which have been overvalued for going on 20 years will occur. The spillover effect will of course be toxic to many entire asset classes, especially equities and other asset backed products, many assets will over-correct in the ensuing fire sale. I plan to bide my time until this occurs and then buy everything I can when there's blood in the streets. Procter & Gamble for 5 cents on the dollar anyone?

Politics is war by other means

Re: 3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group / Negative interest rates

When a country goes into hyperinflation the stock market may never go down when measured in the local currency. However, measured against gold you can be sure of a market crash.Coordinated fires wrote:

One day it will not, and a massive purge of assets which have been overvalued for going on 20 years will occur. The spillover effect will of course be toxic to many entire asset classes, especially equities and other asset backed products, many assets will over-correct in the ensuing fire sale.

-

Coordinated fires

- Posts: 120

- Joined: Sat Jun 25, 2016 9:14 pm

- Location: Merica

Re: 3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group / Negative interest rates

When the time comes, I intend to cash a proportion of my metals and other assets and buy the types of companies that simply don't go out of business.vincecate wrote:

When a country goes into hyperinflation the stock market may never go down when measured in the local currency. However, measured against gold you can be sure of a market crash.

In the aftermath of Germany's defeat basic things were so valued they were practically currency. A lonely GI could buy himself a rather indecent night on the town with a half a bar of soap. Short of an extinction level asteroid strike people are going to be buying coffee and nylons and cigarettes and soap.

Politics is war by other means

Re: 3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group / Negative interest rates

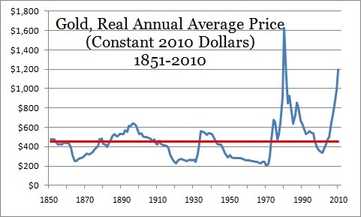

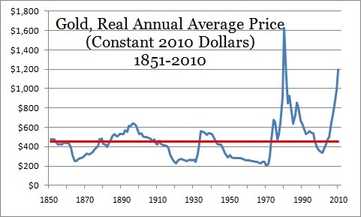

As I've written many times in the past, gold is in a bubble, just like

the stock market. The long-term trend value of gold is around $500

per oz. When the bubble bursts, the price will overshoot and fall to

the $200-300 range, which is where it was around 2000.

Here's an article I wrote in 2011:

** 28-Jul-11 News -- Washington follows Brussels in fraud and extortion

** http://www.generationaldynamics.com/pg/ ... m#e110728b

the stock market. The long-term trend value of gold is around $500

per oz. When the bubble bursts, the price will overshoot and fall to

the $200-300 range, which is where it was around 2000.

Here's an article I wrote in 2011:

** 28-Jul-11 News -- Washington follows Brussels in fraud and extortion

** http://www.generationaldynamics.com/pg/ ... m#e110728b

-

guest

Re: 3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group / Negative interest rates

Everything you are saying about gold flies directly in the face of what so many now believe: that gold will go parabolic (one of their favorite words)!

I read websites like King World News and they have articles forecasting gold $10,000, $20,000 or even $80,000 an ounce! How can this be? Peter Schiff, Egon von Greyerz, Marc Faber, and many others believe gold will rocket in a crisis. Some of these people believe that we are entering a new Dark Age and those without gold will die (no kidding).

Are they missing something or are they just trying to sell gold to suckers?

I read websites like King World News and they have articles forecasting gold $10,000, $20,000 or even $80,000 an ounce! How can this be? Peter Schiff, Egon von Greyerz, Marc Faber, and many others believe gold will rocket in a crisis. Some of these people believe that we are entering a new Dark Age and those without gold will die (no kidding).

Are they missing something or are they just trying to sell gold to suckers?

Re: 3-Aug-16 World View -- Iran furious at Palestinian meeting with Iran opposition group / Negative interest rates

Every bubble in history was denied by experts until it imploded.

Who is online

Users browsing this forum: No registered users and 36 guests