You're being wildly optimistic. Here's my DJIA history page:richard5za wrote: > The Dow has got to 28 000 and on a historic P/E basis is amazingly

> high!

> Even if you think that there won't be a substantial correction,

> from a high base you are not going to get a large percentage

> return going forward. Simple math. I am amazed the stock market of

> the last 10 years. I was, and still am expecting the Dow to

> correct to below its 2001 peak of about 11 400. At 28000 that

> would be a correction of 59%

** DJIA Historical Page

** http://www.generationaldynamics.com/pg/ ... i.djia.htm

The DJIA is currently around 300% of its historic trend value.

It's been above trend value almost continually since 1989, after

recovering from the false panic of 1987.

It's been above 200% of trend value almost continually since

the "irrational exuberance" of 1996. Even the Nasdaq crash

in 2000 barely dented it.

The financial crash of 2008 did dent it a bit, bringing it down to

about 130% of trend value. However, by 2013 it was back above 200% of

trend value by 2013.

It's been around 300% above trend value almost constantly since

January 2018.

This bubble is so huge and has lasted so long, that there are few

people in the world (outside of the Generational Dynamics web site)

who have a clue what's going on.

Your estimated correction of 59% would seem huge and ridiculous to all

the mainstream analysts and politicians, but it's wildly optimistic.

If the DJIA were simply to return to its trend value (from 300% to

100%), there would be a 67% correction.

However, that's not what's going to happen. The Law of Reversion of

the Mean says that in return for the 20 years when the DJIA has been

above trend value, it must be below the trend value, long enough and

deep enough to balance out the 20 years above. And if it overshoots,

as it almost certainly will, then the result will be even lower.

In 1928-33, the DJIA fell 90%. That seems likely to be repeated.

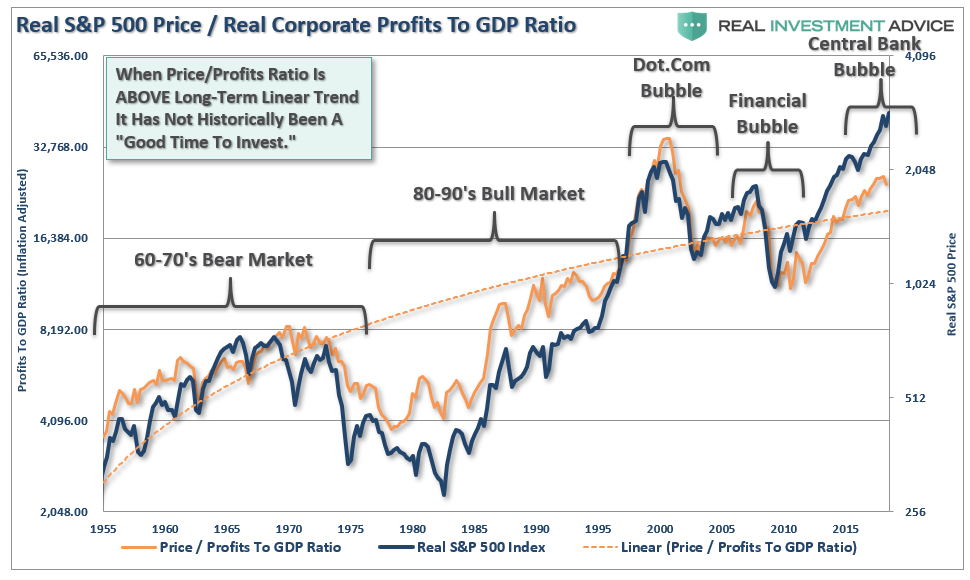

The following graph, which hasn't been updated since 2010, illustrates

all of the above:

- DJIA -- 1900-August 2010 - with exponential growth trend

curve - Log scale

The S&P 500 Price/Earnings ratio is currently around 20, far above its

historical average of 14. Once again, The Law of Reversion of the

Mean applies.

I haven't updated the following chart since 2015, but it shows the

situation:

The blue line shows the historic average, around 13.9. The P/E ratio

has been above the historic average, sometimes way above, since the

1990s. By the Law of Mean Reversion, it will have to fall an

equivalent amount below the historic average to maintain the long-term

average. It fell to the 5-6 range three times in the last century, in

1917, in 1949, and in 1980. That's going to happen again with

absolute certainty, and that means that the Dow Jones Industrial

Average will fall below 3000, from its current level of 26000.

Once again, this implies implies a 90% correction. 59%? It's time for

you to remove your rose-colored glasses.