You appear to be claiming the the identity equations of macro economics are not true. There is nothing complex about them, they simply state that you cannot have the moon, and that 2+2 can never equal anything more than 4. If we have a negative balance of trade, money must leave the country as a net sum, else we get things for nothing. Therefore, if you support WalMart, savings and zero deficit, you have contradicted yourself. It is not possible to have all those things at once. In no way is this DNC talking points, I think the DNC would much rather have the moon, as would the RNC.Reality Check wrote:I believe it because you repeat DNC talking points that you are smart enough to realize are pure fiction.OLD1953 wrote:Odd you believe

I believe it because you cite historical debt levels and then claim current debt levels are within the norm.

I give you the benefit of the doubt and believe that you are smart enough not to drink the Koo-laid you are offering up to others.

Financial topics

Re: Financial topics

Re: Financial topics

http://www.zerohedge.com/news/2013-01-2 ... ruary-2011

Locally we are hitting the storm wall it appears on government seizures of homes.

As of Tuesday, there are more than 1,096 properties with $4,949,400 in unpaid taxes and $1,845,766 in interest and fees.

Properties for which the owners have not met minimum payments by April 1 at 5 p.m. will go into foreclosure.

The treasurer on Monday foreclosed on 346 parcels because of unpaid property taxes. That is the most ever in the county.

I left a forum entry on the amount I had seen during the summer while riding my ten speed all over.

Look guys the red or blue pill is pointless as we try to preserve many levels of defined capital. We lost the Republic to what we had been warned

of. When to mind true issues to ignore what our very fathers already knew and who's fault is that? http://www.wepin.com/articles/afp/index.htm

"They have strived to overawe or seduce printers to stifle and obstruct a free discussion, and have endeavored to hasten it to a decision before the people can duty reflect upon its properties. In order to deceive them, they incessantly declare that none can discover any defect in the system but bankrupts who wish no government, and officers of the present government who fear to lose a part of their power."

better remain single and alone, than blindly adopt whatever a few individuals shall demand, be they ever so wise.

From The Boston Gazette and Country Journal, November 26, 1787.

I would limit government since these assholes are wasting our people to serve a literal multi trillion dollar death cult.

If it was to me some people who no fault of there own are unable to buy food, in addition energy poverty to have heat and oppressive taxing are

to be homeless would be exempt since they paid and have for decades anyway. Fair is one thing to tax, repression is another with all the hidden taxes we bear who can fault old and infirm. Today they do as tyrants. They should be exempt since dues have been paid for decades and the local, state, federal so called civilization is murdering the very liberty they say they protect from above, bullshit on that. We are fighting for there life and trying to get help with EESA and MHA now which really upsets us. These people in power are concerned about things these very ones avoided such as CRA and the likes. This is not a partisan issue and if deluded thinking cannot balance the realm and its check book just fire them. They spend trillions on issue the minority did not want in the first place. I will never vote ever again since it is pointless to pick the owned. It is pointless as we have seen for countless decades and is. The scales are not on our eyes.

The Hell with your majority, you are both wrong. You are butchers and a death cult.

"The conservative message sells," said Saul Anuzis, the former chairman of the Michigan Republican Party. "We're on the right side of history, on the right side of the issues. We just haven't done a very good job on articulating the issues."

Anuzis' analysis is pretty universal in Republican circles. They see the true cause of their problems as merely poor presentations of otherwise good ideas.

No you are not on the right side or is the other side of the isle.

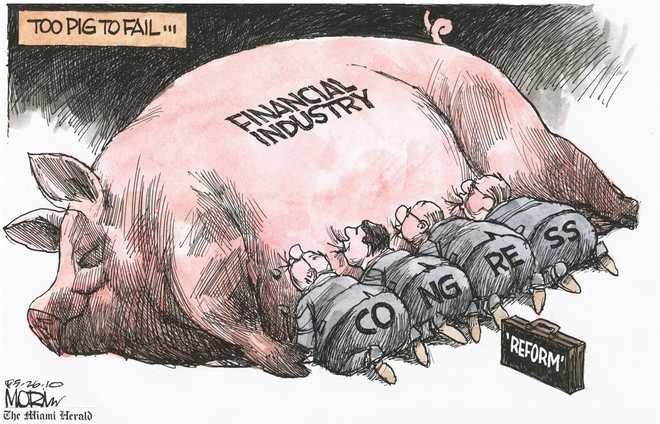

http://www.ritholtz.com/blog/2010/05/too-pig-to-fail/

Locally we are hitting the storm wall it appears on government seizures of homes.

As of Tuesday, there are more than 1,096 properties with $4,949,400 in unpaid taxes and $1,845,766 in interest and fees.

Properties for which the owners have not met minimum payments by April 1 at 5 p.m. will go into foreclosure.

The treasurer on Monday foreclosed on 346 parcels because of unpaid property taxes. That is the most ever in the county.

I left a forum entry on the amount I had seen during the summer while riding my ten speed all over.

Look guys the red or blue pill is pointless as we try to preserve many levels of defined capital. We lost the Republic to what we had been warned

of. When to mind true issues to ignore what our very fathers already knew and who's fault is that? http://www.wepin.com/articles/afp/index.htm

"They have strived to overawe or seduce printers to stifle and obstruct a free discussion, and have endeavored to hasten it to a decision before the people can duty reflect upon its properties. In order to deceive them, they incessantly declare that none can discover any defect in the system but bankrupts who wish no government, and officers of the present government who fear to lose a part of their power."

better remain single and alone, than blindly adopt whatever a few individuals shall demand, be they ever so wise.

From The Boston Gazette and Country Journal, November 26, 1787.

I would limit government since these assholes are wasting our people to serve a literal multi trillion dollar death cult.

If it was to me some people who no fault of there own are unable to buy food, in addition energy poverty to have heat and oppressive taxing are

to be homeless would be exempt since they paid and have for decades anyway. Fair is one thing to tax, repression is another with all the hidden taxes we bear who can fault old and infirm. Today they do as tyrants. They should be exempt since dues have been paid for decades and the local, state, federal so called civilization is murdering the very liberty they say they protect from above, bullshit on that. We are fighting for there life and trying to get help with EESA and MHA now which really upsets us. These people in power are concerned about things these very ones avoided such as CRA and the likes. This is not a partisan issue and if deluded thinking cannot balance the realm and its check book just fire them. They spend trillions on issue the minority did not want in the first place. I will never vote ever again since it is pointless to pick the owned. It is pointless as we have seen for countless decades and is. The scales are not on our eyes.

The Hell with your majority, you are both wrong. You are butchers and a death cult.

"The conservative message sells," said Saul Anuzis, the former chairman of the Michigan Republican Party. "We're on the right side of history, on the right side of the issues. We just haven't done a very good job on articulating the issues."

Anuzis' analysis is pretty universal in Republican circles. They see the true cause of their problems as merely poor presentations of otherwise good ideas.

No you are not on the right side or is the other side of the isle.

http://www.ritholtz.com/blog/2010/05/too-pig-to-fail/

Last edited by aedens on Fri Jan 25, 2013 6:15 pm, edited 4 times in total.

-

Reality Check

- Posts: 1441

- Joined: Mon Oct 10, 2011 6:07 pm

Re: Financial topics

Not only am I NOT claiming that.OLD1953 wrote: You appear to be claiming the the identity equations of macro economics are not true.

I do not even have a clue as to what you were trying to say when you wrote that.

Re: Financial topics

That would be a great cartoon if the President were also sucking on a teat.aedens wrote: No you are not on the right side or is the other side of the isle.

http://www.ritholtz.com/blog/2010/05/too-pig-to-fail/

Re: Financial topics

"S&P 500 closes above 1500; Dow nears 14000"

How are things going, Higgie?

How are things going, Higgie?

Re: Financial topics

Public market destruction: another bifrucation and select asset stripping ongoing. "Successful" (surviving) companies will continue to buy back stock until they effectively go private. The rest will go to zero for stripping. The public float will be a fraction of what it is today. ZIRP is causing the public equity market to select pick equity, now over eight percent of the market and growing. It will continue to exist as an asset class so it will trade at a discount (risk premium). It will be available, and a vehicle to build and maintain wealth, just not you. Private equity will be the only real equity and there will be a velvet rope. You are not invited, and for the always, obtuse way thinking you have been noted. Keep stacking since they will make the money on the way out to fund what is allowed to survive. The disconnect has started, pay attention. These facets will surface more as we move closer to the end of the decade. Remember the slowly walking away on tearups we correctly noted early. This was the arrangements of the seven sisters moving to the five pillars we noted in the papers in the forums. You are not invited as a colocation HFT macroparasite and many other capital factors.

Update: And just so they know what to expect, here is what happened to Apple stock in the last second of regular trading today, courtesy of Nanex. Unlike traditional flash crashes where the trade is an HFT error, or a few shares traded through the entire bid or offer stack, in this case it looks like a very premeditated unloading of some 800K shares (some $350 million worth) of AAPL in the last second, with the full knowledge it was shake the market. Why anyone would want (or wait until the very last second) to do that, while covering the offsetting ES short in the pair trade, to ramp the market into the close, is anyone's guess. h/t t

Update: And just so they know what to expect, here is what happened to Apple stock in the last second of regular trading today, courtesy of Nanex. Unlike traditional flash crashes where the trade is an HFT error, or a few shares traded through the entire bid or offer stack, in this case it looks like a very premeditated unloading of some 800K shares (some $350 million worth) of AAPL in the last second, with the full knowledge it was shake the market. Why anyone would want (or wait until the very last second) to do that, while covering the offsetting ES short in the pair trade, to ramp the market into the close, is anyone's guess. h/t t

Re: Financial topics

Ok what are you saying then? Exactly what incorrect thing have I said that keeps you so angry with me?Reality Check wrote:Not only am I NOT claiming that.OLD1953 wrote: You appear to be claiming the the identity equations of macro economics are not true.

I do not even have a clue as to what you were trying to say when you wrote that.

Couple of nice articles on naked capitalism today.

The calls for indictments before the statute of limitations runs out are getting loud. Perhaps they'll shame the government into action. If there were any persons on capitol hill seriously interested, we'd be having hearings over why no indictments, not Benghazi.

http://www.nakedcapitalism.com/2013/01/ ... thers.html

http://www.nakedcapitalism.com/2013/01/ ... ision.html

**********

(The implicit nature of the assumption is particularly dangerous – and symptomatic of dogma. It is the things we assume out of existence implicitly that are most dangerous because we do not consciously know we have made the assumption and therefore never test its accuracy.)

**********

And that last is part and parcel of every problem we face now, the implicit assumptions which are never tested.

Re: Financial topics

Models have been back tested. Maybe yours has not? The response time is under four minutes on hunter seeker algo's now. This is not the creative destruction mode of economies of scale we are dealing with. Malinvestment is a real factor and we have covered this on the macro cluster groups of scale. Beta is fine as a play on the way out not on the way forward. Life at the margin is running out of fiat debt serfs here. Conditions in Asia will kill more than have the ability to service debt. Trends do take time as do energy margins going forward.

The current AUM carry trade may be winding down we noted a long time ago. I will look at some numbers later how this nets out from this offset noted.

Few remember the visit for the initial toxic sausage the Aussies threw back at the DC face to face and the current pivot of inertia to effect some conclude.

http://www.defensenews.com/article/2012 ... nding-Cuts

When this leverage train meets calls we will see who is allowed to survive. Mises had one thing correct and more will find just what that was. When? as in who knows the hour, but we can see the season approaching. Water, Wheat, Weather then look around. As noted already some off the table and distorted is a understatement. They are pumping money to algo's and HFT as the citizens waste away. Look around guys we are just starting to peak here after how many years. Turn off the damn set and walk about, it's real and now here for us. Good luck souls...

Just seen a pic of the next President they want in. Run from this nation as fast as you can. They will say and do anything as we have seen.

We are past troubled status. I seen Tina Turner turned in her passport. Best decision I seen in the press today.

Waiting for the I will bend the trend to show itself. Citizens are fed up with the fast and furious children the retards sent.

http://www.newyorker.com/reporting/2012 ... rentPage=1

Both sides ignore you every day and as you can see who just paid for that. Hedge fund and private equity managers know that all have been all talk

and no action when it comes to what they really care about as the carried interest loophole.

Does not matter who, or more closely to convey what you vote for it since matters zero to you debt serfs in a plantation nation.

Idiots.

https://mises.org/daily/1228/The-Fed-is-as-the-Fed-Does review for the eco literate.

When their policies fail, central bankers blame markets, speculators and any convenient target for the problems. They also, tacitly or overtly, inject bigger and bigger doses of inflation into the economy, even though this is what caused the problems in the first place.

Today on que the presstitutes blamed budgeting as the linkage effect on our woes. Unbelievable unless you heard for yourself...

Enjoy the chains the majority set upon you as we drown in avarice above and stupidity below.

Rothbard, in his monetary history, wrote that in a typical year in the 1920s, some 700 banks failed with deposits totaling $170 million. After the crash, the number was 17,000 banks a year, totaling some $1.08 billion in deposits. There are no accident's in politics as FDR noted just intent. Wake up...

https://www.youtube.com/watch?feature=p ... 9bP-LbR8u8

The current AUM carry trade may be winding down we noted a long time ago. I will look at some numbers later how this nets out from this offset noted.

Few remember the visit for the initial toxic sausage the Aussies threw back at the DC face to face and the current pivot of inertia to effect some conclude.

http://www.defensenews.com/article/2012 ... nding-Cuts

When this leverage train meets calls we will see who is allowed to survive. Mises had one thing correct and more will find just what that was. When? as in who knows the hour, but we can see the season approaching. Water, Wheat, Weather then look around. As noted already some off the table and distorted is a understatement. They are pumping money to algo's and HFT as the citizens waste away. Look around guys we are just starting to peak here after how many years. Turn off the damn set and walk about, it's real and now here for us. Good luck souls...

Just seen a pic of the next President they want in. Run from this nation as fast as you can. They will say and do anything as we have seen.

We are past troubled status. I seen Tina Turner turned in her passport. Best decision I seen in the press today.

Waiting for the I will bend the trend to show itself. Citizens are fed up with the fast and furious children the retards sent.

http://www.newyorker.com/reporting/2012 ... rentPage=1

Both sides ignore you every day and as you can see who just paid for that. Hedge fund and private equity managers know that all have been all talk

and no action when it comes to what they really care about as the carried interest loophole.

Does not matter who, or more closely to convey what you vote for it since matters zero to you debt serfs in a plantation nation.

Idiots.

https://mises.org/daily/1228/The-Fed-is-as-the-Fed-Does review for the eco literate.

When their policies fail, central bankers blame markets, speculators and any convenient target for the problems. They also, tacitly or overtly, inject bigger and bigger doses of inflation into the economy, even though this is what caused the problems in the first place.

Today on que the presstitutes blamed budgeting as the linkage effect on our woes. Unbelievable unless you heard for yourself...

Enjoy the chains the majority set upon you as we drown in avarice above and stupidity below.

Rothbard, in his monetary history, wrote that in a typical year in the 1920s, some 700 banks failed with deposits totaling $170 million. After the crash, the number was 17,000 banks a year, totaling some $1.08 billion in deposits. There are no accident's in politics as FDR noted just intent. Wake up...

https://www.youtube.com/watch?feature=p ... 9bP-LbR8u8

- Attachments

-

- nutjob.jpg (6.35 KiB) Viewed 5872 times

Re: Financial topics

http://www.cyberwarnews.info/reports/a- ... eak-files/

ssdd: This is open season, but you won't get too far, Cause you got to blame someone for your own confusion.

So to summarize: since December 2007:

•The stock market is now green

•US population : +12 million

•US workers who have left the labor force: +9.6 million

•US civilian labor force: +1.6 million

•Jobs for Americans aged 55 and above: +5 million

That's the good news. The bad:

•Total jobs: -4 million

•Jobs for workers aged 16-54: -8 million t/y t

I think we are seeing the life boat analogy playing out and the GD is on course. Still trying to clutch that lucid point on cautious optimism

is wearing thin even on my part. Today's main page analysis rings very direct and on course.

ssdd: This is open season, but you won't get too far, Cause you got to blame someone for your own confusion.

So to summarize: since December 2007:

•The stock market is now green

•US population : +12 million

•US workers who have left the labor force: +9.6 million

•US civilian labor force: +1.6 million

•Jobs for Americans aged 55 and above: +5 million

That's the good news. The bad:

•Total jobs: -4 million

•Jobs for workers aged 16-54: -8 million t/y t

I think we are seeing the life boat analogy playing out and the GD is on course. Still trying to clutch that lucid point on cautious optimism

is wearing thin even on my part. Today's main page analysis rings very direct and on course.

Last edited by aedens on Sun Jan 27, 2013 7:32 am, edited 1 time in total.

-

Higgenbotham

- Posts: 7487

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Financial topics

Great. Comfortably 100% short with plenty of firepower left.John wrote:"S&P 500 closes above 1500; Dow nears 14000"

How are things going, Higgie?

An analyst I know has been asked to speak at MIT later this year. He asked if I would like to go with him. I said maybe, let's see how things go. I suppose if I do that, we can meet while I'm there. Part of my message back to him today with some current thoughts is quoted below.

He told me he heard from an old Wall Street hand this morning who thinks this bubble is going to break hard soon, with a 75% loss in the stock market in less than a month. I don't know about that, but it's getting more interesting now and more dangerous too.

The person I mentioned last weekend, the Boomer with 40 years of experience, said today that this is the most extreme set of circumstances he has seen and it is going to end badly.

I don't find myself being that excited about it, but just feel comfortable that the craziness is close to the end. The jacking of the market over 1500 at day end and the headlines are for public consumption, a desperate attempt to unload onto a recalcitrant public who is no longer drinking the Kool-Aid. Who will be left holding the bag?

"The point you made about mortgage nonpayments contributing to spending is something I had also attributed to the Apple bubble. The tech companies have the most clever operators and they know how to take the electronic printed money and sweep it into their coffers. Notice that when they do that, the money just sits there. Bonds go on the Fed's balance sheet and the electronic printed money winds up on the tech company balance sheets. People have a few electronic toys or maybe a virtual footprint or memory. Then we are back to square one. Unfortunately for us, Steve Jobs is no longer alive and we can't be sure as to whether Apple's problem is due to "lack of Steve" or whether it is due to lack of excess money to sop up. I suspect more the latter as tech in general is having trouble, but of course not as much trouble as Apple is having.

As you state, I agree the Fed is very powerful and also agree with your correspondent that the Fed has increased the fragility of the markets by decreasing the time scale upon which the crash can occur. Also importantly, the Fed has increased the fragility of the world order, which I will talk about below.

I believe there is now a limit in the S&P futures. I don't believe there was a limit during the flash crash. If there is some kind of daily limit the Fed can step in at some point when the market is limit down and buy. This would buy time and might temporarily prevent a crash below 1010.

Going further, the index is one thing, but since Apple has been crashing I've begun to think about the components of the index. If only the value of the index is supported, many components of the index could tend toward zero, while some others tend toward infinity. This would be unsustainable and would cause the index to eventually crash to zero, given time. Therefore, the only way Bernanke can save the index once that begins to occur (and it already is occurring) would be to buy the individual component heavyweights like Apple and put the Apple, etc., stock on the Fed's balance sheet.

Going beyond the idea of monetary support, it might also be necessary to support the profits of some of the individual companies in order to keep the S&P up. Profit is sort of the uncontrollable component as the overall system tends toward loss and debt has been used to create artificial profits.

Finally, we then have to step outside the realm of economics toward political and social factors as the Fed attempts further and more obvious machinations. Would there be social unrest? Would Obama be impeached if Bernanke buys individual stocks? Would a foreign power attack our financial markets? Would war break out? In any case, I think what happens outside of the economy will determine things more and more as the crisis unfolds. I think civil unrest and world war are likely if the Fed continues siphoning wealth to the center to keep it afloat and picking winners and losers."

Last edited by Higgenbotham on Sat Jan 26, 2013 11:26 pm, edited 4 times in total.

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

Who is online

Users browsing this forum: Bing [Bot] and 142 guests