I think so. As you imply, it could be similar to the response to 9-11 without the hot war. Put the hammer down internally on US citizens as they did with DHS, and use what was learned from that to concentrate all resources towards internal repression.Reality Check wrote:A cold war would work just as well as a hot war for these purposes.

Inflation, deflation, gold and currencies

-

Higgenbotham

- Posts: 7487

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Inflation, deflation, gold and currencies

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

Re: Inflation, deflation, gold and currencies

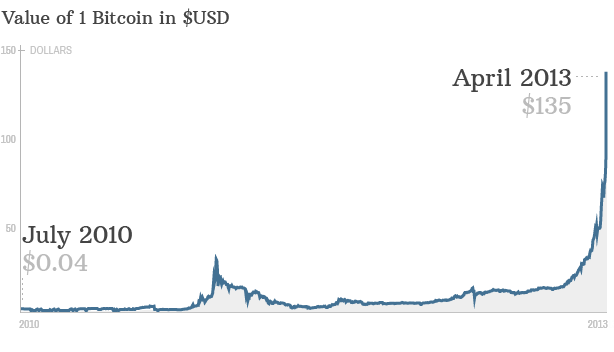

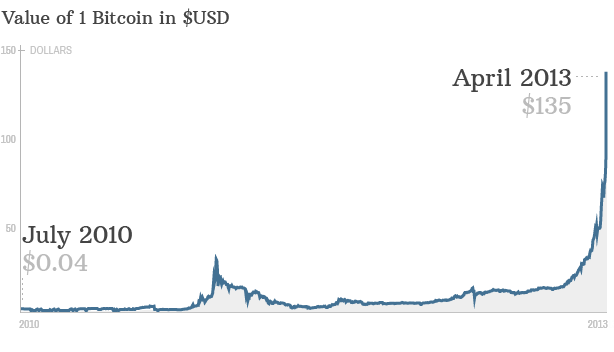

John (and others), you have not chimed in on the "bitcoin" issue...seems to be in a bubble, but should we all convert our cash to this?

http://www.businessinsider.com/bitcoin- ... 115-2013-4

http://www.businessinsider.com/bitcoin- ... 115-2013-4

Re: Inflation, deflation, gold and currencies

Dear David,

"mass" and its "momentum".

The "mass" measures the number of governments and institutions that

hold the currency in their porfolios, or the size of the assets they

hold that are denominated in the currency.

The "momentum" measures the length of time (in decades or centuries)

that it's been a viable, valuable currency.

By those measures, the US dollar is by far the most survivable

currency. Given its current mass and momentum, I believe that it

would be practically impossible to hyperinflate it.

Other currencies that score high on this measure are the British pound

sterling and the Japanese yen.

The euro is too young to have enough mass and momentum to be entirely

survivable, but it's close.

The bitcoin has almost no mass and no momentum. I don't expect it to

survive at all.

In my opinion, the parabolic bubble described in the article

that you've referenced is a disaster for the bitcoin. It

may mean that the bitcoin won't survive much longer.

In my opinion, the survivability of a currency is correlated to itsshoshin wrote: > John (and others), you have not chimed in on the "bitcoin"

> issue...seems to be in a bubble, but should we all convert our

> cash to this?

> http://www.businessinsider.com/bitcoin- ... 115-2013-4

"mass" and its "momentum".

The "mass" measures the number of governments and institutions that

hold the currency in their porfolios, or the size of the assets they

hold that are denominated in the currency.

The "momentum" measures the length of time (in decades or centuries)

that it's been a viable, valuable currency.

By those measures, the US dollar is by far the most survivable

currency. Given its current mass and momentum, I believe that it

would be practically impossible to hyperinflate it.

Other currencies that score high on this measure are the British pound

sterling and the Japanese yen.

The euro is too young to have enough mass and momentum to be entirely

survivable, but it's close.

The bitcoin has almost no mass and no momentum. I don't expect it to

survive at all.

In my opinion, the parabolic bubble described in the article

that you've referenced is a disaster for the bitcoin. It

may mean that the bitcoin won't survive much longer.

Re: Inflation, deflation, gold and currencies

Hyperinflation does not depend on how many people are using a currency or how long it has been around. It depends on the debt and deficit levels of the government who controls a central bank.John wrote: By those measures, the US dollar is by far the most survivable

currency. Given its current mass and momentum, I believe that it

would be practically impossible to hyperinflate it.

Other currencies that score high on this measure are the British pound

sterling and the Japanese yen.

I have a simulation so you can see, in general, how hyperinflation works. You can see the feedback loops and how things spiral out of control. Nobody should think my simulation can predict the timing of US or Japanese hyperinflation. At least not yet.

http://howfiatdies.blogspot.com/2013/03 ... ation.html

Re: Inflation, deflation, gold and currencies

The article below describes the bitcoin bubble and how bitcoin works.

Assuming that all the technical claims are true, in particular that

it's impossible for a hacker to create new bitcoins on his own, then

it's caused me to change my mind about bitcoins.

I now think that it has a decent chance of survival -- not as a

currency, but as commodity store of value similar to gold, but without

some of the disadvantages of gold. A person can "take possession" of

bitcoins a lot more easily than he can take possession of gold, and

the bitcoins could not be confiscated by the government. That's why

bitcoins are heavily used in Belarus and Ukraine, according to the

article.

Gold salesmen may wish to consider looking into bitcoins as a

sideline.

Assuming that all the technical claims are true, in particular that

it's impossible for a hacker to create new bitcoins on his own, then

it's caused me to change my mind about bitcoins.

I now think that it has a decent chance of survival -- not as a

currency, but as commodity store of value similar to gold, but without

some of the disadvantages of gold. A person can "take possession" of

bitcoins a lot more easily than he can take possession of gold, and

the bitcoins could not be confiscated by the government. That's why

bitcoins are heavily used in Belarus and Ukraine, according to the

article.

Gold salesmen may wish to consider looking into bitcoins as a

sideline.

> The Bitcoin Bubble and the Future of Currency

> A few days ago, the value of all the bitcoins in the world blew

> past $1 billion for the first time ever. That’s an impressive

> achievement, for a purely virtual currency backed by no central

> bank or other authority. It’s also temporary: we’re in the middle

> of a bitcoin bubble right now, and it’s only a matter of time

> before the bubble bursts.

> There are a couple of reasons why the bubble is sure to burst. The

> first is just that it’s a bubble, and any chart which looks like

> the one at the top of this post is bound to end in tears at some

> point. But there’s a deeper reason, too — which is that bitcoins

> are an uncomfortable combination of commodity and currency. The

> commodity value of bitcoins is rooted in their currency value, but

> the more of a commodity they become, the less useful they are as a

> currency.

> ...

> https://medium.com/money-banking/2b5ef79482cb

Re: Inflation, deflation, gold and currencies

An interesting observation regarding a section of Athens going to an all cash local society, and reducing ties and trust in central government, including the police. It is indicated as a possible future outcome as a revolt against national government.

This also raises the question, - what is the real Greek GDP?

http://economicsfortherestofus1.blogspo ... s-new.html

This also raises the question, - what is the real Greek GDP?

http://economicsfortherestofus1.blogspo ... s-new.html

Re: Inflation, deflation, gold and currencies

Has anyone noticed that junk silver bags, $500 and $1000 face, have become scarce at several PM sources? And the spread between cash silver and the futures has widened significantly. Cash sell offers have not been tracking downward in this break for the last 3 weeks.

Re: Inflation, deflation, gold and currencies

Silver is down 7% more so far Sunday evening. Wow. Higgie, you exactly called the silver top, care to make a prediction on the silver bottom?

http://www.silverseek.com/quotes/24silver.php

-- Vince

http://www.silverseek.com/quotes/24silver.php

-- Vince

Re: Inflation, deflation, gold and currencies

The margin requirments for SLV have gone from 25% to 40%. Not that I am buying on margin, but since I have options on SLV my broker's computer sent me an email.

This kind of thing can help silver go even lower.

-- Vince

This kind of thing can help silver go even lower.

-- Vince

-

Higgenbotham

- Posts: 7487

- Joined: Wed Sep 24, 2008 11:28 pm

Re: Inflation, deflation, gold and currencies

I haven't been paying much attention to silver for the past couple years until this week. You might remember I was wrong about thinking it would break $26 sooner than it did. Just off the top of my head, I would look at where silver seemed to spend a lot of time these past couple years, and I think that number was most commonly about $34. $26 is $8 under that and going another $8 is $18. Before the big move higher didn't silver rest at $18 for a few months? Seems like it. If I were wanting to buy, and didn't have any, I might think about buying between here and $16 in increments. I don't want to buy it yet but am getting a little interested vs being not interested at all over $26.vincecate wrote:Higgie, you exactly called the silver top, care to make a prediction on the silver bottom?

While the periphery breaks down rather slowly at first, the capital cities of the hegemon should collapse suddenly and violently.

Who is online

Users browsing this forum: aeden, Google [Bot] and 151 guests