Alot of moving parts betting on tech for market segment earnings direction. Specs.

The tbills rolling off are twenty percent back into tbill and cash.

We are only going to watch a few dead cats bounces and the carcasses

of the dead cats strewn around from dxy and fx issues that developed.

If/then rope burn into sweeps positions will be based on numbers from the usual suspects known here also

as doctor copper and max pain also as 0dte shunts vvix observations.

The files warranted the tear up operations when we marveled at green shoots rhetoric's before.

The 0dte changed the dead cats numbers around the sheep pens.

https://www.cboe.com/insights/posts/the ... y-in-2022/

https://investorplace.com/2023/01/why-i ... w-in-2023/

At the top of today’s Digest, we noted how the latest Q3 GDP projection is for 5.8% growth. That’s sizzling hot.

https://investorplace.com/2023/08/treas ... on-stocks/

And yes, we could point toward plenty of indicators showing slowing growth but let’s maintain perspective – that slowing growth is the result of the Fed’s efforts to tamp down recent explosive growth.

The comment as mean reversion was noted by John to the moving averages as the 20 ma, 50 ma, 200 ma as we actually considered

good luck they will own the Universe with the put wall to nail gains with a view slow at first then all at once of the current beauty pageant.

If it corrects or when we will see what crosses the River.

A few more clot shots will plant them in vascular dementia anyways for the long vacation.

https://www.washingtonexaminer.com/rest ... n=msn_feed

Search found 214 matches: vix

Searched query: vix

- Mon Aug 21, 2023 12:34 pm

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

- Thu Feb 16, 2023 12:04 pm

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

Re: Financial topics

This is a real possibility.John wrote: ↑Thu Feb 16, 2023 9:49 amThursday, February 16, 2023

Big discussion on Bloomberg tv this

morning about "zero day options." These

are options that expire today, rather

than in a few weeks or months.

According to the analyst, these are very

highly leveraged investments (100x), and

so are very high risk, and are currently

being purchased at very high volume

(i.e., gambling). However, since they

expire so quickly, the high volume is

not being captured by the VIX. Thus,

this may be the next surprise "crash."

Notice that inflation quite clearly can't be beat down, either. It's what is making the Fed's job so difficult. They have had to hike faster than any other time in history and they have no idea what's going to happen, and still the disinflation isn't very big.

- Thu Feb 16, 2023 9:49 am

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

Re: Financial topics

Thursday, February 16, 2023

Big discussion on Bloomberg tv this

morning about "zero day options." These

are options that expire today, rather

than in a few weeks or months.

According to the analyst, these are very

highly leveraged investments (100x), and

so are very high risk, and are currently

being purchased at very high volume

(i.e., gambling). However, since they

expire so quickly, the high volume is

not being captured by the VIX. Thus,

this may be the next surprise "crash."

Big discussion on Bloomberg tv this

morning about "zero day options." These

are options that expire today, rather

than in a few weeks or months.

According to the analyst, these are very

highly leveraged investments (100x), and

so are very high risk, and are currently

being purchased at very high volume

(i.e., gambling). However, since they

expire so quickly, the high volume is

not being captured by the VIX. Thus,

this may be the next surprise "crash."

- Tue Jan 03, 2023 4:08 pm

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

Re: Financial topics

After this dead cat bounce, we will look at vix and smart to retail indicators.

As indicated, we are looking at money flow index closer. Watch the price channels closer for now.

The aptly named “Smart Money/Dumb Money” Confidence indicator is one of our favorite measures of investor sentiment.

The indicator uses “real money” gauges to track what different groups of investors are actually doing with their money.

As R indicated find more indicators for price channel for moves.

As indicated, we are looking at money flow index closer. Watch the price channels closer for now.

The aptly named “Smart Money/Dumb Money” Confidence indicator is one of our favorite measures of investor sentiment.

The indicator uses “real money” gauges to track what different groups of investors are actually doing with their money.

As R indicated find more indicators for price channel for moves.

- Mon Dec 26, 2022 10:33 pm

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

Re: Financial topics

Margin debt is all the rage this week to run away like the monte python skit

as dumb money to smart indicator intersects.

While invectives rule the inter week volumes mute the vix is suspected may just be so.

Maybe they will come out and play at 15x forward earning as they still play with dolls from another time tested confidence

brighter than the Sun. I think V your project will get some funding and yea do not be that guy who left it on table

to damn long in options. It looks like after last weeks sweeps they are reloading short positions.

Either way the gaps to be filled are already slated in. The easy money it watching the store chains

being looted for EBITDA margin. No surprises at hand so maybe its priced in was the meme of the week.

Dead cats and yea margin debt will finally finish off the genuises.

https://status.advisorperspectives.com/ ... n-november

Looks like they got the memo.

Lance Roberts of Real Investment Advice analyzes margin debt in the larger context that includes free cash accounts and credit balances in margin accounts. Essentially, he calculates the Credit Balance as the sum of Free Credit Cash Accounts and Credit Balances in Margin Accounts minus Margin Debt. Very good person to listen to. https://status.advisorperspectives.com/ ... n-november

Me I see some sideways action but watch PPI and BIS GDP issues for and into late January. EBITDA margin still is in the swirl for the end of year furloughs.

Dutch: verlof, "leave of absence"

March 2023 and yes it has a 100 percent record to date calling it. https://www.conference-board.org/us/

Sweeps then guys as noted. They already knew and know.

https://www.youtube.com/watch?v=FILR9-i54cg

thread: xrip

as dumb money to smart indicator intersects.

While invectives rule the inter week volumes mute the vix is suspected may just be so.

Maybe they will come out and play at 15x forward earning as they still play with dolls from another time tested confidence

brighter than the Sun. I think V your project will get some funding and yea do not be that guy who left it on table

to damn long in options. It looks like after last weeks sweeps they are reloading short positions.

Either way the gaps to be filled are already slated in. The easy money it watching the store chains

being looted for EBITDA margin. No surprises at hand so maybe its priced in was the meme of the week.

Dead cats and yea margin debt will finally finish off the genuises.

https://status.advisorperspectives.com/ ... n-november

Looks like they got the memo.

Lance Roberts of Real Investment Advice analyzes margin debt in the larger context that includes free cash accounts and credit balances in margin accounts. Essentially, he calculates the Credit Balance as the sum of Free Credit Cash Accounts and Credit Balances in Margin Accounts minus Margin Debt. Very good person to listen to. https://status.advisorperspectives.com/ ... n-november

Me I see some sideways action but watch PPI and BIS GDP issues for and into late January. EBITDA margin still is in the swirl for the end of year furloughs.

Dutch: verlof, "leave of absence"

March 2023 and yes it has a 100 percent record to date calling it. https://www.conference-board.org/us/

Sweeps then guys as noted. They already knew and know.

https://www.youtube.com/watch?v=FILR9-i54cg

thread: xrip

- Tue Nov 08, 2022 8:20 pm

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

Re: Financial topics

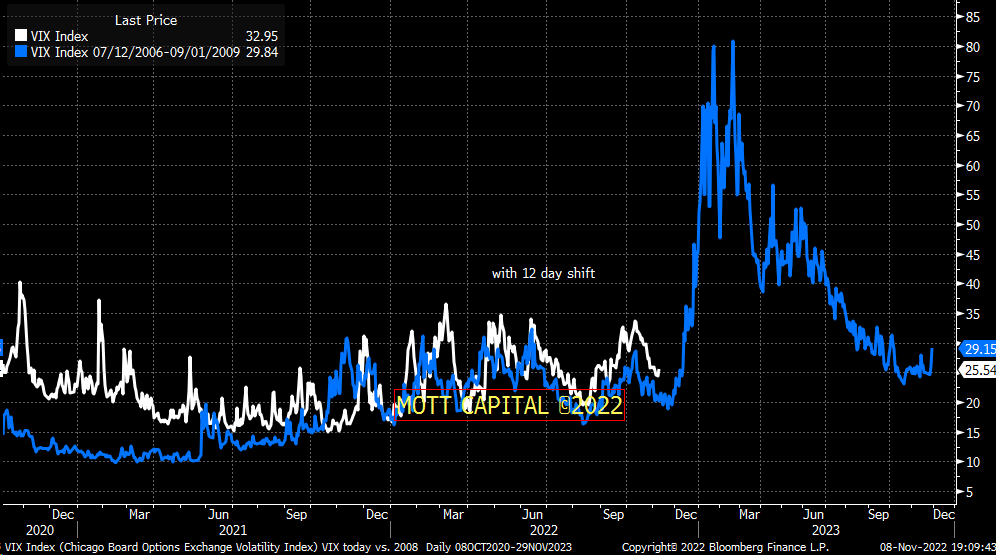

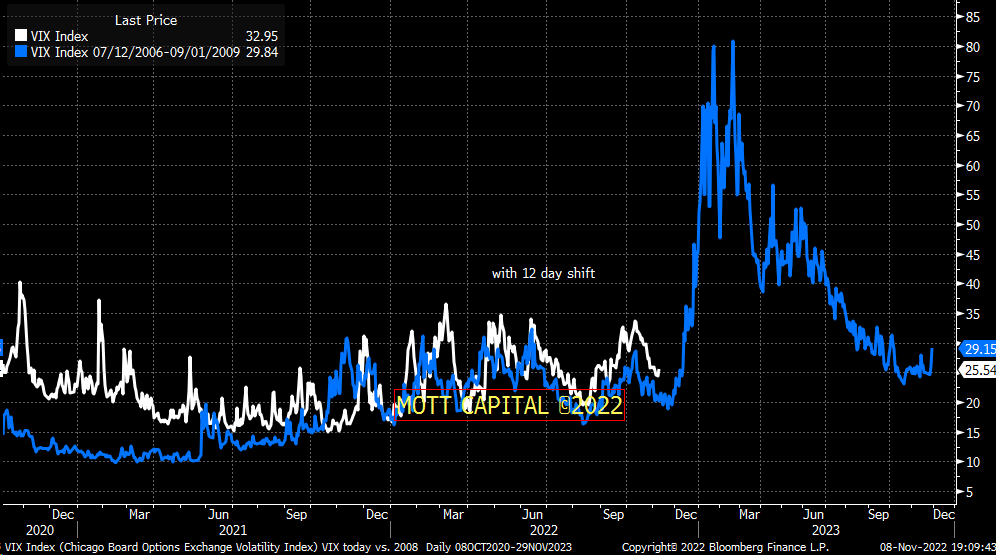

If the VIX keeps following 2008 we have excitement just ahead:

- Fri Oct 21, 2022 12:53 pm

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

Re: Financial topics

There's a big difference between a dark age and a destroyed economy. In any non apocalyptic scenario where gold is useful, BTC is more useful. That's just the fact. If it's all bartering, with not internet or electric grid, goods and food are more useful than gold. The point here is the check on our sensationalism. It pretty much doesn't matter if the world irrevocably changes, which is the reason to invest in something like BTC right now, since its upside is WAY HIGHER than every asset imaginable. In just 6 years (common) people will be kicking themselves for missing out on one of the last millionaire makers that was possible.Higgenbotham wrote: ↑Thu Oct 20, 2022 12:28 pmThere are many reasons, as previously discussed, and completely separate from my other assertion that Bitcoin was in a bubble, which was what most of last year's back and forth was about. One of them is embedded within my post. If we're going into a dark age or a destroyed economy, there will be no surpluses at most times in most places and in that case barter will be preferred or necessary. We're certainly not at that point yet or even close. The shelves are still full and as mentioned in a recent post throughputs are not down much. But the companies with no profits are still standing too.Cool Breeze wrote: ↑Thu Oct 20, 2022 11:54 amIf you agree with this it is confusing to me why you have been so anti-BTC for the time we've been on the board. It is already a major help and safety for most other citizens in inflation economies (all way worse than the US), and as confidence in everything continues to plummet, you have it as the best use case by far.Higgenbotham wrote: ↑Wed Oct 19, 2022 8:41 pm

I sent this quote from you to a family member. I've been saying for over a decade that Bernanke's actions and those that followed destroyed the world economy and will send the world into a new dark age, but it didn't really resonate. Sometimes people need to hear it from someone else in different words for it to really come across. The way you put it here resonated much better. I feel this is the cliff notes version that the average person needs to know - "they destroyed the economy..., that is done and can not be changed". I think things have also reached a point where most people can see this more clearly. That may mean the crash we have been talking about is close. There's been some mention this week of VIX call buying at strikes of 100 and over for the first half of next year. But the fact that they are buying now says to me any time in the next few months is the bet.

If Vince and I agree, and we've explained what's going on, why would others look into what we say more, if not trust us? It's a rather strange phenomenon similar to what I've posted on other threads in the forum.

- Thu Oct 20, 2022 12:28 pm

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

Re: Financial topics

There are many reasons, as previously discussed, and completely separate from my other assertion that Bitcoin was in a bubble, which was what most of last year's back and forth was about. One of them is embedded within my post. If we're going into a dark age or a destroyed economy, there will be no surpluses at most times in most places and in that case barter will be preferred or necessary. We're certainly not at that point yet or even close. The shelves are still full and as mentioned in a recent post throughputs are not down much. But the companies with no profits are still standing too.Cool Breeze wrote: ↑Thu Oct 20, 2022 11:54 amIf you agree with this it is confusing to me why you have been so anti-BTC for the time we've been on the board. It is already a major help and safety for most other citizens in inflation economies (all way worse than the US), and as confidence in everything continues to plummet, you have it as the best use case by far.Higgenbotham wrote: ↑Wed Oct 19, 2022 8:41 pmI sent this quote from you to a family member. I've been saying for over a decade that Bernanke's actions and those that followed destroyed the world economy and will send the world into a new dark age, but it didn't really resonate. Sometimes people need to hear it from someone else in different words for it to really come across. The way you put it here resonated much better. I feel this is the cliff notes version that the average person needs to know - "they destroyed the economy..., that is done and can not be changed". I think things have also reached a point where most people can see this more clearly. That may mean the crash we have been talking about is close. There's been some mention this week of VIX call buying at strikes of 100 and over for the first half of next year. But the fact that they are buying now says to me any time in the next few months is the bet.vincecate wrote: ↑Tue Oct 18, 2022 11:36 amThey destroyed the economy with a decade of zero interest rates, that is done and can not be changed.

The Austrian Economists call this "malinvestment". If you can borrow money for near zero-percent then

all sorts of stupid business ideas look reasonable. We have had far more foolish than "pets.com" this time.

https://en.wikipedia.org/wiki/Malinvestment

Going forward the choice is between destruction with hyperinflation and destruction without-hyperinflation.

My bet is they think they want to control inflation long enough to crash the bond, stock, real estate markets,

then they decide to print and we get hyperinflation.

If Vince and I agree, and we've explained what's going on, why would others look into what we say more, if not trust us? It's a rather strange phenomenon similar to what I've posted on other threads in the forum.

- Thu Oct 20, 2022 11:54 am

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

Re: Financial topics

If you agree with this it is confusing to me why you have been so anti-BTC for the time we've been on the board. It is already a major help and safety for most other citizens in inflation economies (all way worse than the US), and as confidence in everything continues to plummet, you have it as the best use case by far.Higgenbotham wrote: ↑Wed Oct 19, 2022 8:41 pmI sent this quote from you to a family member. I've been saying for over a decade that Bernanke's actions and those that followed destroyed the world economy and will send the world into a new dark age, but it didn't really resonate. Sometimes people need to hear it from someone else in different words for it to really come across. The way you put it here resonated much better. I feel this is the cliff notes version that the average person needs to know - "they destroyed the economy..., that is done and can not be changed". I think things have also reached a point where most people can see this more clearly. That may mean the crash we have been talking about is close. There's been some mention this week of VIX call buying at strikes of 100 and over for the first half of next year. But the fact that they are buying now says to me any time in the next few months is the bet.vincecate wrote: ↑Tue Oct 18, 2022 11:36 amThey destroyed the economy with a decade of zero interest rates, that is done and can not be changed.

The Austrian Economists call this "malinvestment". If you can borrow money for near zero-percent then

all sorts of stupid business ideas look reasonable. We have had far more foolish than "pets.com" this time.

https://en.wikipedia.org/wiki/Malinvestment

Going forward the choice is between destruction with hyperinflation and destruction without-hyperinflation.

My bet is they think they want to control inflation long enough to crash the bond, stock, real estate markets,

then they decide to print and we get hyperinflation.

If Vince and I agree, and we've explained what's going on, why would others look into what we say more, if not trust us? It's a rather strange phenomenon similar to what I've posted on other threads in the forum.

- Wed Oct 19, 2022 8:41 pm

- Forum: Finance and Investments

- Topic: Financial topics

- Replies: 29822

- Views: 15711009

Re: Financial topics

I sent this quote from you to a family member. I've been saying for over a decade that Bernanke's actions and those that followed destroyed the world economy and will send the world into a new dark age, but it didn't really resonate. Sometimes people need to hear it from someone else in different words for it to really come across. The way you put it here resonated much better. I feel this is the cliff notes version that the average person needs to know - "they destroyed the economy..., that is done and can not be changed". I think things have also reached a point where most people can see this more clearly. That may mean the crash we have been talking about is close. There's been some mention this week of VIX call buying at strikes of 100 and over for the first half of next year. But the fact that they are buying now says to me any time in the next few months is the bet.vincecate wrote: ↑Tue Oct 18, 2022 11:36 amThey destroyed the economy with a decade of zero interest rates, that is done and can not be changed.

The Austrian Economists call this "malinvestment". If you can borrow money for near zero-percent then

all sorts of stupid business ideas look reasonable. We have had far more foolish than "pets.com" this time.

https://en.wikipedia.org/wiki/Malinvestment

Going forward the choice is between destruction with hyperinflation and destruction without-hyperinflation.

My bet is they think they want to control inflation long enough to crash the bond, stock, real estate markets,

then they decide to print and we get hyperinflation.